A couple of weeks ago, the WSJ featured another article comparing Index Funds and ETFs titled “A Close Race, a Surprising Finish.”

A couple of weeks ago, the WSJ featured another article comparing Index Funds and ETFs titled “A Close Race, a Surprising Finish.”

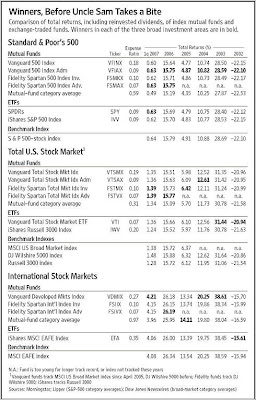

With the help of Morningstar, they crunched some ETF numbers all the way back to 1997 and looked at before and after-tax returns. The ‘before-tax’ analysis is shown in the table below (double click to enlarge):

The surprising conclusion was that big, low-cost index funds from Fidelity and Vanguard outperformed the ETFs in most scenarios; however the differences were extremely small. Personally, I look at it like the “boxers vs. briefs” discussion; it’s simply a matter of preference.

Contact Ulli

Whichever you select for your portfolio will not matter at all if you don’t follow a strategy that gets you out of either during a bear market. In the bigger scheme of things, how can making ½% more on the upside possibly be of any importance if the downside has the potential to take some 30-50% out of your wallet?

In my view, that’s where the main focus should be.