1. Moving the Markets

As I mentioned two days ago, March has never been a predictable month historically. Volatility remained in full force again today as stocks tumbled amidst a major sell-off that saw the Dow drop 200 points. The good news is, that the S&P 500 and Nasdaq were able to manage their negative hits today to come out on top over all for the month. What may bring some sunshine to the table though is that this is the Nasdaq’s 9th straight quarterly gain and its longest quarterly winning streak in history, which has many investors remaining bullish on the tech index.

The price of the USD has continued to weigh on investors’ minds as the currency has officially gained 9% for the year and is expected to continue rising in the near future. Speculation as to the tentative (never predictable) hike in interest rates has also been contributing to volatility of late. It shall be interesting to see what the month of April will entail from the Fed.

Shall optimistic bulls charge forward in April? Well, the first trading day of the second quarter (April 1) is just around the corner and has shown strong performance over the past 20 years. Historically, the S&P 500 has advanced 16 times with an average gain of 0.56 percent (according to the Stock Trader’s Almanac).

Let’s see if 2015 brings a historical repeat.

In an abrupt reversal from yesterday, our 10 ETFs in the Spotlight slipped and closed lower. Leading the downside was our YTD winner healthcare (XLV) with -1.73%, while Consumer Discretionaries (XLY) held up best with a loss of only -0.44%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

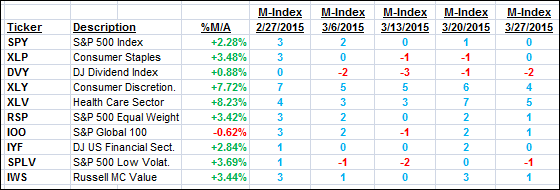

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

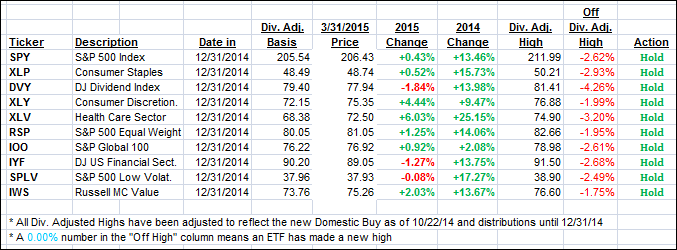

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) shifted in reverse by gving back yesterday’s gains as the bears maintained the upper hand. Howver, we still remain on the bullish side of the trend lines by the following percentages:

Domestic TTI: +2.75% (last close +3.46%)—Buy signal effective 10/22/2014

International TTI: +3.29% (last close +3.97%)—Buy signal effective 2/13/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli