1. Moving The Markets

Major U.S. indexes rose broadly Wednesday, helped by a report out of the nation’s central bank that showed Fed policymakers want to be absolutely certain the U.S. economy had recovered before starting to raise interest rates. Feeling at ease that the Fed won’t raise rates until sometime next year, investors seemed to feel a bit more comfortable pursuing the market’s more risky investments, with Biotech and Tech stocks attracting much of the focus. Utilities and Telecommunications stocks, which are traditionally considered more conservative investments, suffered as a consequence.

Facebook (FB) was a big success today gaining 7.25%. Aluminum giant Alcoa (AA) reported an adjusted first-quarter profit that was well ahead of analysts’ forecasts. The aluminum maker is typically the first large U.S. Corporation to report its results every quarter. Alcoa rose 47 cents, or 4%, to $13. On a negative note, Intuitive Surgical (ISRG), the maker of robotic surgical equipment, slumped 7%. The company warned that first-quarter sales would be drastically lower than previously expected.

In other markets, gold and crude oil inched higher after the Fed minutes. European stocks and most of Asia, with the exception of the Nikkei 225 also rose today.

Our 10 ETFs in the Spotlight joined the party and headed north; 2 of them made new highs while 9 of them remain positive YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

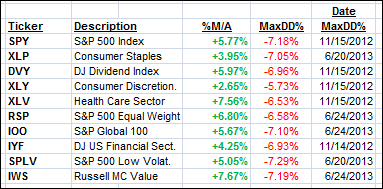

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

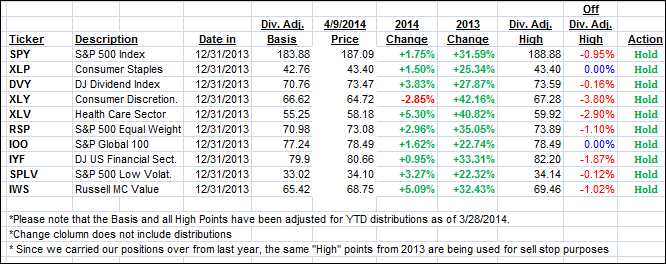

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) rallied and closed as follows:

Domestic TTI: +2.89% (last close +2.13%)

International TTI: +4.30% (last close +3.33%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli