The biggest news item last Friday and all weekend has been the collapse of Bear Stearns after their stock value got sliced in half.

The biggest news item last Friday and all weekend has been the collapse of Bear Stearns after their stock value got sliced in half.

Had it not been for the intervention of the Fed via JP Morgan, the markets would have tanked big time. To me, it was a clear case of a company being to big to let go because of the ramifications for all Wall Street firms. It’s not that Bear Stearns is the biggest player on Wall Street; they are big enough via their complex derivative trading schemes and tied in with many other investment banking firms that one failure would have had devastating effects on the other players as well.

I talked about this interconnectivity in “Counter Party Risk,” describing how leverage and derivatives have created a worldwide spider web tying international banks together in a scheme that will only hold if everyone sticks to their end of the bargain. If one fails, the domino effect can’t be calculated until the last domino has fallen since no one knows exactly who is tied into this web with how much capital or leverage. The Fed will be absolutely helpless because of the vast amounts of money involved.

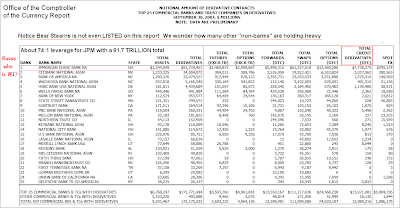

I recently posted that derivative contracts are valued worldwide around $50 trillion. I guess I was wrong as recent reports put that number closer to $500 trillion. Mish over at Economic Trend Analysis made reference to the following chart from the Office of the Comptroller regarding derivative contracts (the comments are his, not mine):

However, given the enormous numbers involved, I have no idea what kind of a lifeline needs to be thrown to pull the participants out of this cesspool of worthless securities. But I do know that this environment can be extremely hazardous to your financial health if you haven’t sold your domestic and international equity funds. Events could now unfold at warp speed.

Comments 1

Ulli,

all the statistics cited are impressive if not scary to the observer. However, we are operating under a fractional reserve system which has brought about tremendous prosperity so have most recent financial inventions. Are you suggesting to go back to a bartering system with correspondingly low prosperity? We need to keep cool heads and see ourselves through this crisis which is manageable by the willing and the fit. Opportunities are knocking. Hermann