- Moving the market

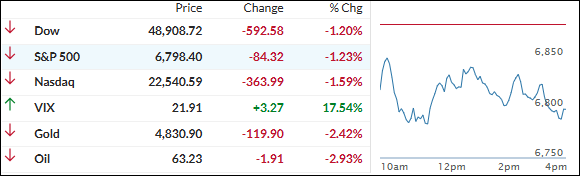

Markets opened weak and never really recovered—the bears were in full control, driving a sharp, one-sided selloff across almost everything.

The major indexes dove lower, with tech getting hit especially hard and Bitcoin sinking toward $65,000 (after briefly dipping below $70,000, a level many saw as key support).

The trigger was Alphabet’s earnings: they projected a big jump in AI spending (up to $185 billion in capex for 2026), which spooked some investors who want to see revenue growth catch up first. Shares fell 5%.

Broadcom bucked the trend and jumped almost 2% on the spending news (hope for chip suppliers), but most of the AI crew felt the pain. Qualcomm slid 7% on a weaker forecast tied to a global memory shortage.

The selloff spilled into software (now in its 8th straight down day) and precious metals.

Silver crashed as much as 19% overnight (after liquidation in Shanghai flowed into U.S. markets), while gold briefly touched $5,000 before losing it.

The dollar extended yesterday’s gains, bond yields dropped, and the whole move had the fingerprints of margin calls and forced deleveraging—Bitcoin being the easiest 24/7 asset to liquidate.

In the end, it was a violent, red-dominated day with no late recovery in sight. Breadth was ugly—only about 200 S&P 500 names stayed green.

When even the metals sell off and the bears dominate a day like this, this feels like a normal, healthy breather after a strong run… but I am wondering if the pullback might have a little more room to run before the bullish crowd steps back in?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bears were completely in charge from start to finish, bringing big swings and plenty of volatility.

Pretty much everything ended up closing in the red—no real safe havens today.

Even the metals, which have been our go-to lately, couldn’t escape the selling pressure and got dragged lower too. Bullish sentiment was basically nowhere to be found.

Our TTIs took a hit as well and retreated with the broader market. The domestic one held up a bit better than the international one, but both gave back some ground.

This is how we closed 02/05/2026:

Domestic TTI: +6.78% above its M/A (prior close +7.71%)—Buy signal effective 5/20/25.

International TTI: +10.89% above its M/A (prior close +12.14%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli