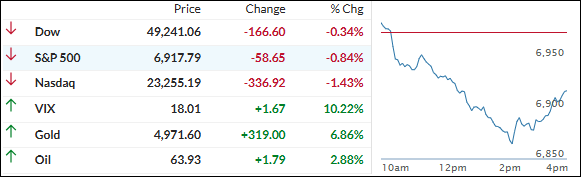

- Moving the market

The Dow briefly tagged a new record high early on as traders kept rotating out of tech and into more economy-sensitive names.

The broader market had a mixed day, but the tone felt like “value and cyclical stocks are back in play” after recent weakness.

In healthcare, Merck jumped more than 3% (and was the Dow’s biggest gainer at +3.5%) after crushing Q4 earnings and revenue on strong demand for its cancer immunotherapy and other products.

Pepsi added about 4% on solid organic sales growth across the board. Banks joined the party too—JPMorgan and Wells Fargo up around 2% each, Citigroup gaining about 1%.

Palantir popped 6% on strong Q4 results and upbeat guidance.

On the flip side, most tech names were in the red. Nvidia and Microsoft each shed 2%, adding to their rough start to 2026. Software stocks continued struggling—ServiceNow -7%, Salesforce -5%.

The big support came from metals: gold and silver each surged over 6%, copper ripped almost 4.5%. That helped offset the equity weakness.

The Mag 7 massively underperformed the rest of the S&P 493 again, with the majors closing mostly red (Nasdaq led the downside). Only small caps found enough juice to eke out a green finish.

Bond yields ended lower after an early spike, the dollar mirrored that softness, Bitcoin went nowhere (dipped to ~$73K but bounced back toward $76K), and silver was the most volatile — spiking 12% at one point before settling back.

Historically, February is the second-weakest month of the year—mid-month gains often vanish by the end. Will that pattern repeat this time around?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

We started the day looking pretty cheerful with a nice early bounce, but that positive mood didn’t stick around long.

Bears jumped in quick, took control, and pushed the major indexes into the red by the close.

The Nasdaq got hit hardest—tech just fell out of favor again and dragged everything down with it.

The real hero?

The metals sector. Gold, silver, and copper all posted solid gains and basically carried the day while stocks struggled.

Our TTIs had a split personality: the international one actually improved and gained ground, while the domestic one pulled back a bit.

This is how we closed 02/03/2026:

Domestic TTI: +6.78% above its M/A (prior close +7.07%)—Buy signal effective 5/20/25.

International TTI: +11.82% above its M/A (prior close +11.02%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli