- Moving the market

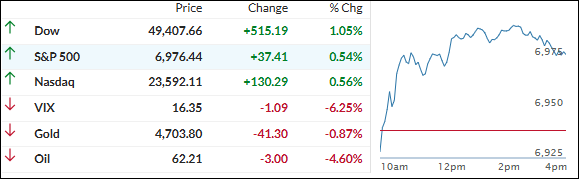

The major indexes opened with some early juice as Wall Street kicked off a fresh month, shrugging off last week’s drama in silver and bitcoin.

The mood quickly steadied, and by the end we closed solidly higher across the board—dip buyers stepped in and lifted everything.

Bitcoin had a rough go early, dipping below $80,000 for the first time since April (a clear sign of risk-off vibes after Friday’s bloodbath in metals).

Silver had plunged around 30% on Friday—its worst single-day drop since 1980—while gold fell about 10% in what many called one of the most blatant short squeezes to bail out leveraged bank positions.

Both metals (and BTC) bounced off their lows today, trimming losses and helping ease the broader risk-off pressure. Bitcoin recovered above $78K, gold and silver each down roughly 4% by the close.

Traders also kept an eye on Nvidia amid growing questions about AI spending. Reports surfaced that Nvidia’s planned $100 billion investment in OpenAI has stalled, with execs expressing doubts about the deal. Nvidia shares slipped about 1%.

Earnings season ramps up this week with over 100 S&P 500 companies reporting, including Amazon and Alphabet (both higher today). Season’s been solid so far, though we’ve seen some high-profile post-earnings dumps (Microsoft being a recent example).

Bond yields rose on strong manufacturing data, giving the dollar a modest rebound.

When the Dow powers ahead like this while the broader market plays catch-up, it feels likes classic rotation into value and stability… or are tech and growth names just taking a breather?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day started pretty sluggish — indexes were just drifting sideways with no real spark.

But then the buyers woke up, bullish sentiment took over, and everything found its footing. By the close, all the major indexes finished with solid gains—nice turnaround.

The Dow was the clear standout, outperforming the others by a wide margin and carrying the blue-chip energy.

Our TTIs rode the wave right along with the market—both advanced nicely and kept the positive trend looking strong.

This is how we closed 02/02/2026:

Domestic TTI: +7.07% above its M/A (prior close +6.52%)—Buy signal effective 5/20/25.

International TTI: +11.02% above its M/A (prior close +10.51%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli