ETF Tracker StatSheet

You can view the latest version here.

LATE PANIC-BID SAVES THE WEEK – S&P FLAT AFTER ROLLERCOASTER

- Moving the market

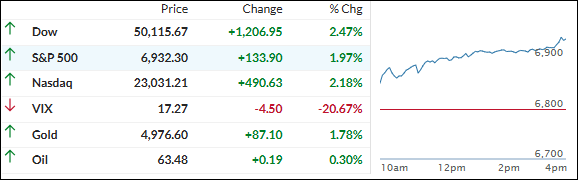

The Dow surged 1,200 points (about 2.5%) and blasted through 50,000 for the first time ever, flipping positive for the week. The S&P 500 jumped 2%, the Nasdaq added 2.2%, and the S&P clawed its way back into the green for 2026 overall.

Nvidia and Broadcom were two of the big winners, each up 7% after getting crushed earlier in the week. Oracle, Palantir, and other beaten-down names bounced too as traders started scooping up cheaper levels.

The vibe felt like a “great recalibration” in progress—money rotating out of high-growth tech into value and cyclical areas (industrials, financials, etc.).

Value massively outperformed growth this week, with the Mag 7 underperforming the S&P 493 by a wide margin. Microsoft is now down 30% from its all-time high.

Bitcoin staged a monster rebound, climbing 11% to get back above $70,000 after briefly tanking below $61,000 overnight (more than 52% off its October 2025 record of $126,000).

Precious metals recovered too, though silver lagged for the week. Gold pushed toward $5,000 again but came up short.

Bond yields ended the week lower (rate-cut expectations soared on weak labor data and the puking in stocks), and the dollar finally turned higher.

A late-day panic-bid (possibly sparked by Fed’s Daly saying 1–2 more rate cuts may be needed) helped lift the S&P to flat on the week.

With the Dow smashing 50,000, tech bouncing hard, value leading the charge, and Bitcoin clawing back big, does this feel like the market’s shaking off the mid-February slump early and setting up for more upside?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

After yesterday’s sea of red, the market flipped the script hard and delivered a full-on sea of green.

Everything catapulted higher from the open, with the Dow leading the charge and closing above 50,000 for the very first time. What a milestone!

The metals jumped right on board and surged along with stocks, while Bitcoin staged an impressive recovery, clawing back a ton of ground in one day.

Our TTIs were right there in the thick of it too—they more than made up for yesterday’s pullback and closed with some solid gains.

This is how we closed 02/06/2026:

Domestic TTI: +8.29% above its M/A (prior close +6.78%)—Buy signal effective 5/20/25.

International TTI: +11.99% above its M/A (prior close +10.89%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli