ETF Tracker StatSheet

You can view the latest version here.

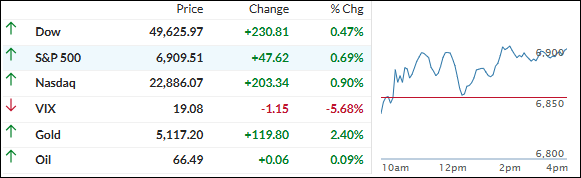

SILVER +7%, GOLD BACK ABOVE $5,100 – METALS KEEP WINNING

- Moving the market

Stocks bounced back nicely after opening lower, as the Supreme Court struck down most of President Trump’s sweeping tariff policy under the International Emergency Economic Powers Act.

The majority ruled the law “does not authorize the President to impose tariffs,” which lifted retailers and companies that had been hammered by higher import and manufacturing costs last year.

The ruling didn’t address refunds for tariffs already paid, but Wall Street largely expected the decision anyway—economists think the White House will find other ways to reimpose many of the same duties, so the market reaction stayed pretty muted.

Earlier in the day, Q4 GDP came in softer than expected at 1.4% (vs. the forecasted 2.5%), a sharp slowdown from the 4.4% gain in Q3.

December core PCE inflation (the Fed’s favorite gauge) held steady at 3% YoY—above the 2% target but in line with estimates. That combo gave the Fed a bit more breathing room but didn’t spark any fireworks.

By week’s end, the S&P 500 and Nasdaq rallied to finish higher, though uncertainty around the Court’s decision and what comes next is still the big story.

Mega-cap tech bounced back despite ongoing software weakness. Bond yields rose for the week (helping the dollar), but precious metals surged anyway—silver led with a +7% weekly gain, while gold pushed back above $5,100 for a modest weekly advance.

Bitcoin had a rough week but ended to the upside, potentially breaking out of its recent downtrend channel.

Right now, it feels like the market’s shrugging off the uncertainty and is ready for the next leg up… on the other hand, we could witness more chop until we see how the White House responds and NVDA’s earnings hit next week.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes opened a bit soft, but the dip didn’t last long—the buyers jumped in quick and kept the upward momentum rolling all session.

There was a brief mid-day wobble back to the flat line, but they shook it off and closed solidly higher.

The rally felt genuinely broad-based this time—stocks across the board joined in, and even the metals and bitcoin got in on the fun and pushed higher right alongside.

Our TTIs tagged along perfectly too—they both maintained their cushion above their long-term trend lines.

This is how we closed 02/20/2026:

Domestic TTI: +8.42% above its M/A (prior close +8.39%)—Buy signal effective 5/20/25.

International TTI: +11.80% above its M/A (prior close +12.15%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli