- Moving the market

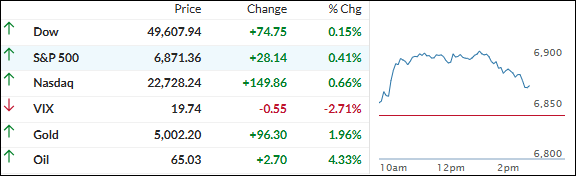

The major indexes jumped right out of the gate and held onto solid gains most of the day, fueled by strength in key tech names, as traders waited for the Fed’s latest minutes and eyed the big PCE inflation report coming Friday.

Nvidia climbed more than 2% after Meta announced it’s going to load up on millions of Nvidia chips for its data-center buildout.

Amazon added 2% too, boosted by filings showing Bill Ackman’s Pershing Square grew its stake by 65% in Q4—making it the fund’s third-largest holding (nice vote of confidence after Amazon snapped a nine-day losing streak).

Oil prices popped as traders digested fresh U.S.-Iran tensions—VP JD Vance said Iran didn’t meet red lines in this week’s nuclear talks and military options are still on the table.

Macro data this morning helped too: durable goods orders beat, housing starts & permits surged more than expected, and industrial production came in strong.

The Fed minutes showed a few members open to rate hikes if needed, which nudged rate-cut expectations lower and gave bond yields a moderate lift.

The dollar broke out higher, while Bitcoin mirrored that move early then faded after the release.

Gold topped $5,000 today and closed up 2%, with silver and copper also posting positive days. Mega-cap tech did its classic pump-and-dump, but the broader market held firm.

We’re past the halfway point in February now, and history says the back half of the month usually isn’t kind to stocks.

Will it be different this time?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls were calling the shots right from the opening bell, and the positive sentiment stayed strong all session long—no real pullbacks, just steady upward pressure.

The major indexes closed nicely higher, capping off a clean win.

The metals complex bounced back in a big way too—gold, silver, and copper all posted solid advances and kept the momentum rolling.

Our TTIs followed right along with the good vibes, delivering nice gains that confirm our current bullish outlook is still very much justified.

This is how we closed 02/18/2026:

Domestic TTI: +8.62% above its M/A (prior close +8.06%)—Buy signal effective 5/20/25.

International TTI: +12.38% above its M/A (prior close +12.00%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli