- Moving the market

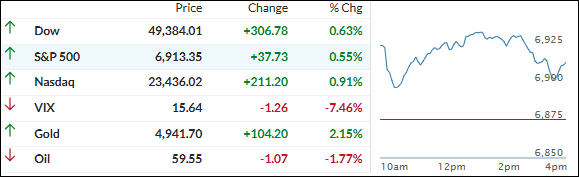

Stocks picked up right where they left off yesterday, riding a wave of relief after President Trump dialed back the heat on Europe.

He announced he’s scrapping the new tariffs on imports from eight NATO nations that were set to kick in Feb. 1.

Instead, he said he and NATO Secretary General Mark Rutte have “formed the framework of a future deal” on Greenland—and later told CNBC “We have a concept of a deal.”

That, plus his earlier Davos comment that he won’t take Greenland by force, helped ease geopolitical nerves big time.

The major indexes opened strong, pulled back from mid-session highs, but still closed solidly green. The short squeeze kept rolling, so small caps outperformed again, even though mega-cap tech had a decent bounce and nearly got back to flat for the week.

Bond yields were mixed, the dollar slid (now down YTD), and that weakness gave precious metals another boost.

Gold dipped early but powered higher to top $4,900 for the first time, closing just a whisker away from $5,000.

Silver and platinum stole the show even more—silver jumped 3.5%—as commodities keep breaking out to the upside.

On a personal note, I’ll be out of the office tomorrow but back Monday with fresh market commentary.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls were running the show from start to finish—nice, steady upward grind all session long.

There was a little late-day wobble (classic profit-taking), but they shook it off without breaking a sweat and closed solidly in the green. Clean win.

The metals were the real MVPs again, cranking out some seriously outsized returns—gold, silver, and the crew just keep flexing.

Our TTIs held up great too. Both stayed positive, but the international one really stole the show and outperformed its domestic sibling by a good margin.

This is how we closed 1/22/2026:

Domestic TTI: +8.29% above its M/A (prior close +8.15%)—Buy signal effective 5/20/25.

International TTI: +10.63% above its M/A (prior close +9.72%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli