- Moving the market

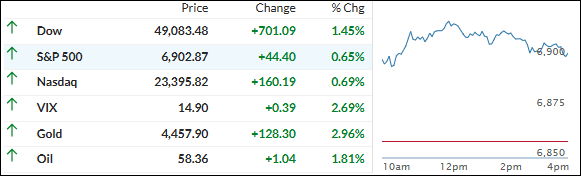

Markets kicked off with a surge right out of the gate—even with the weekend’s big news about the U.S. strike on Venezuela and the capture of Nicolás Maduro.

Crude oil barely budged (no major supply fears), so traders shrugged off the geopolitics and bet it wouldn’t spiral into broader chaos.

Energy stocks stole the early spotlight on hopes they’d cash in on rebuilding Venezuela’s oil infrastructure (the country has the world’s largest proven reserves). Chevron ripped 4%+ as the clear frontrunner with its existing operations there, and Exxon Mobil added over 1%.

The vibe felt like classic January money rotation: folks putting cash back to work after year-end tax-loss selling and portfolio tweaks, keeping the risk-on mood alive.

All the majors closed sharply higher, led by the Dow and small caps (huge short squeeze in play—up 8% in two days for some!). The Mag 7 started hot but faded late, letting the S&P 493 take the win for the day.

But the real stars? Metals went nuts again: copper +5%+, silver strong alongside, and gold up a solid 2.9%—all pushing new records. Bond yields eased, Bitcoin found its groove and climbed toward $95K.

I am pondering: With energy popping on Venezuela hopes, metals still on fire, and stocks shaking off the news, does this feel like the risk-on train is back on track for 2026?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls showed up early and never let go—major indexes kept grinding higher all session long with steady, confident buying.

No real pullbacks, just nice upward momentum from open to close.

The real fireworks, though, were in the metals sector. Silver and copper went nuts, both jumping over 5% and stealing the spotlight once again.

Our TTIs were right there with the party—both posted solid gains and stretched their lead above their trend lines a bit more.

This is how we closed 1/05/2026:

Domestic TTI: +6.70% above its M/A (prior close +5.72%)—Buy signal effective 5/20/25.

International TTI: +10.33% above its M/A (prior close +9.34%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli