- Moving the market

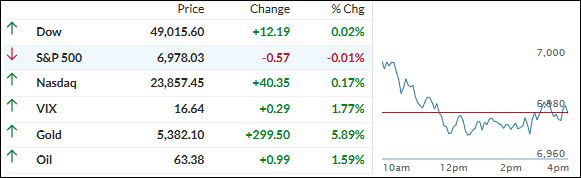

The S&P 500 finally touched 7,000 for the first time intraday—nice milestone! —but the broader rally ran out of steam by the close.

Chip stocks gave us an early boost after some upbeat earnings: Seagate soared more than 17% on strong AI data storage demand, and ASML reported record orders with solid 2026 guidance. That juiced the sector for a while, but the gains mostly faded by the end.

Traders were also watching the dollar after its big drop Tuesday (worst day since last April), though it clawed back a bit today.

The macro picture still looks decent—growth holding up, labor market soft but stable, inflation above the Fed’s target—so there wasn’t much case for an immediate rate cut.

The Fed held steady as expected, and Chair Powell’s comments didn’t drop any big surprises, so markets basically shrugged.

In the end, the major indexes closed near flat, with only the Nasdaq squeaking out a tiny gain. Bond yields were all over the place, rate-cut expectations dipped, but the dollar showed some life.

The real action?

Precious metals crushed it again—gold ETF and silver ETF both surged over 3.8%, gold topped $5,300, and silver chopped around but closed near $115. Bitcoin followed suit and climbed back above $90K.

After the Fed passed on a cut and stocks faded but metals keep holding strong, does this feel like a classic “no news is bad news” reaction… or a healthy reminder that hard assets are still doing the heavy lifting in this environment?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

We kicked off the day on a positive note with some early buying, but that enthusiasm evaporated once the Fed announced its decision.

The central bank kept rates unchanged (no cut, despite some hopes), signaling they’re happy with current conditions. That disappointment took the wind out of the sails pretty quickly.

The major indexes pulled back from their morning highs, with only the Nasdaq managing to hang on for a small green close.

The real standout once again? The precious metals—they shone brightly, delivering solid gains while stocks struggled.

Our TTIs mostly treaded water and retreated just a tiny bit—nothing material enough to shake the bigger picture.

This is how we closed 1/28/2026:

Domestic TTI: +7.03% above its M/A (prior close +7.40%)—Buy signal effective 5/20/25.

International TTI: +10.95% above its M/A (prior close +11.45%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli