ETF Tracker StatSheet

You can view the latest version here.

GOLD NEARS RECORD, SILVER SOARS 10%, AND THE BULL RUN ROLLS ON

- Moving the market

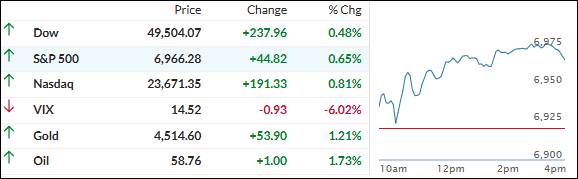

Stocks kicked off the day on a strong note after the latest jobs report, with the Dow and S&P 500 both climbing into record territory before settling back a bit.

The December employment data was a mixed bag—it showed payrolls rising by 50,000, slightly below expectations for 73,000, but still signaling that the U.S. economy is moving forward, even if slowly.

The unemployment rate ticked down to 4.4%, surprising economists who had forecast 4.5%, which traders took as a hint that the labor market has enough resilience to support growth without overheating.

Still, given the numbers’ ambiguity, the report didn’t really clear things up for the Fed—it’s strong enough to keep policymakers cautious for now but soft enough to leave the door open to further cuts later if conditions weaken.

Adding to the mix, the Supreme Court delayed its ruling on the legality of President Trump’s broad tariffs, leaving trade policy uncertainty lingering in the background. That decision could have far-reaching fiscal and market implications once it lands.

For the week, all the major indexes finished higher, led by small caps, which surged 5% thanks to a hefty short squeeze.

The “Mag 7” lagged again, as the rest of the S&P 500’s 493 stocks picked up the slack.

Meanwhile, bond yields were mixed, and the dollar had a solid week—but that didn’t stop gold from charging back toward record highs. Silver stole the spotlight, soaring 10% and outpacing everything in sight, with platinum not far behind.

Copper added a respectable 3.7%, while Bitcoin ended the week roughly flat after losing steam midweek.

With small caps ripping, metals on fire, and Bitcoin holding its ground, the setup heading into mid-January looks strong—but will the market’s broad energy and hard‑asset momentum be enough to keep the bull party going?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls took over right from the opening bell and never looked back.

The major indexes built on that early momentum all session long and cruised to a solid green close—nice, clean win.

Small caps were the star of the week with a strong +5% gain, but silver absolutely crushed it, rocketing +10% to steal the show by a mile.

Our TTIs were right there partying with the rest—both delivered another winning week and kept the positive trend rolling.

This is how we closed 1/09/2026:

Domestic TTI: +7.75% above its M/A (prior close +7.69%)—Buy signal effective 5/20/25.

International TTI: +10.03% above its M/A (prior close +10.24%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli