- Moving the market

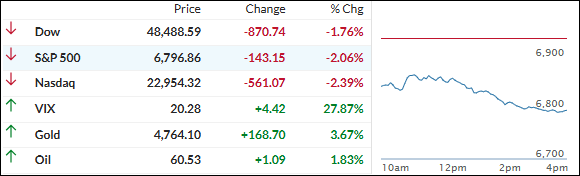

Stocks got absolutely hammered right out of the gate after President Trump cranked up the heat on Greenland again.

In a Truth Social post over the weekend, he threatened escalating tariffs on imports from eight NATO members (starting at 10% on Feb 1 and jumping to 25% by June 1) unless they agree to sell Greenland to the U.S.

He also hit France with a 200% tariff threat on wine and champagne (Macron apparently isn’t joining his “Board of Peace”) and slammed the U.K. over the Chagos Islands handover as a “national security disaster” that makes Greenland even more critical.

European leaders called it “unacceptable,” with France pushing the EU to hit back hard using its Anti-Coercion Instrument.

That geopolitical mess sparked a full-on flight from U.S. assets—Treasury yields spiked, the dollar sold off, and the major indexes dove deep into the red. The Nasdaq led the downside, mega-caps hit their lowest since Thanksgiving, and the Mag 7 massively underperformed the rest of the S&P 493.

The one bright spot?

Our precious metals holdings saved the day big time. Gold surged +3.7% to a new all-time high above $4,750, and the silver ETF added a strong +5.4% around the $94 level. Those moves more than offset the equity losses, leaving our portfolios nicely in the green overall.

Bitcoin didn’t help much and got pushed back down to the $90K area.

On the hopeful side, equities have strong seasonal tailwinds right now—can that provide enough support to stabilize things after today’s meltdown, or is the geopolitical/tariff noise too loud to ignore?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Right from the opening bell, the bears were running the show—no question about it.

The major indexes got smacked early and never really found their footing. Every little recovery attempt fizzled out fast, so we ended up closing solidly in the red.

The one bright spot?

Precious metals came through big time—gold and silver both posted hefty gains and basically saved the day (at least for our portfolios). They were the only ones holding the line while everything else struggled.

Our TTIs couldn’t escape the downdraft either—they gave back some of their recent gains—but they’re still comfortably sitting on the bullish side of their long-term trend lines, so the bigger picture stays positive.

This is how we closed 1/20/2026:

Domestic TTI: +6.35% above its M/A (prior close +7.96%)—Buy signal effective 5/20/25.

International TTI: +8.84% above its M/A (prior close +10.14%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli