- Moving the market

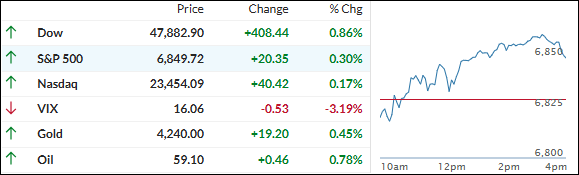

Stocks got off to a wobbly start but eventually found their legs, with all the major indexes closing in the green, led by the Dow while the Nasdaq lagged a bit.

Traders spent the day digesting weaker economic data and what it might mean for the Fed’s next move as the last policy meeting of the year approaches.

Microsoft slipped about 2% after headlines claimed it was cutting AI-linked software sales quotas, a story the company pushed back on. Other big AI names moved lower in sympathy, with Nvidia slightly in the red, Broadcom off more than 1%, and Micron Technology down around 2%.

The tone improved after ADP’s report showed private payrolls unexpectedly falling by 32,000 in November instead of rising, as economists had forecast.

That weak reading, along with a sharp dive in broader U.S. macro data, reinforced the idea that the Fed is now effectively locked into a rate cut next week, turning this into yet another “bad news is good news” day for risk assets.

Rate-cut expectations stayed pinned at 100% for December and even ticked higher for January, with odds for an additional move next month climbing above 30%.

Small Caps enjoyed a strong session thanks to a hefty short squeeze, and many AI-related names joined that rebound trade, even if some mega caps finished mixed.

In the background, bond yields edged lower, the dollar extended its pullback, and gold managed a modest gain while silver basically went sideways.

Bitcoin added to yesterday’s strength and pushed above $93,000, and copper quietly turned in a standout performance with a solid move higher.

ZeroHedge also highlighted how heavily this year’s S&P 500 returns have leaned on a handful of AI giants—without them, the index would have delivered less than half of its nearly 19% year-to-date gain.

With so much riding on a small group of AI leaders and the Fed seemingly one weak data point away from more easing, the big question is whether this “bad news is good news” dynamic can keep propping up the market—or if concentration risk and a softening economy will eventually catch up with the bulls.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day kicked off looking a little messy—early jitters had things wobbling—but buyers stepped in, shook it off, and pushed us to a quiet green close.

The Dow was the clear leader, while tech actually took a back seat for once. The real story?

The broad market finally showed up and outperformed – I like seeing that kind of healthy action.

That wider participation gave our TTIs a nice boost. Both posted solid little gains and are sitting even more comfortably in positive territory, which just reinforces the upbeat outlook we’ve got right now.

This is how we closed 12/03/2025:

Domestic TTI: +6.40% above its M/A (prior close +5.59%)—Buy signal effective 5/20/25.

International TTI: +9.84% above its M/A (prior close +9.34%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli