- Moving the market

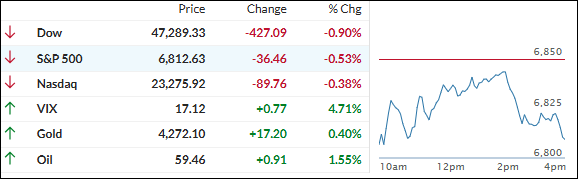

Stocks kicked off December on the back foot, opening lower and taking their cues from another rough day in crypto as volatility rolled right into the final month of 2025.

Broadcom and Super Micro Computer dropped more than 3% and 2%, signaling more profit-taking in crowded artificial intelligence trades, while Synopsys jumped after Nvidia unveiled a new investment and partnership, helping Nvidia shares edge about 1% higher.

Bitcoin slid more than 5% and broke back below $87,000, giving up its latest comeback attempt after already dipping under $90,000 late last month and struggling to reclaim that level.

That weakness came even as Wall Street is coming off a strong prior week, when the Dow and S&P 500 each gained over 3% and the Nasdaq rallied nearly 5%, partly repairing November’s damage that left the S&P 500 and Dow only modestly higher for the month while the Nasdaq fell about 1.5%, snapping a seven-month winning streak.

Seasonals still look friendly: historically, December has been one of the better months for stocks, with the S&P 500 averaging a bit more than a 1% gain and ranking as the benchmark’s third-strongest month going back to 1950.

Traders are leaning on that backdrop and the now near-universal expectation of a Fed rate cut next week, especially with recent soft economic data—like today’s drop in the ISM Manufacturing Index—adding to the case for easier policy even as bond yields popped higher in a bit of a “good news is bad news” twist.

Overseas, the Bank of Japan’s more hawkish tone and rising odds of a December rate hike rattled funding markets and hit liquidity-sensitive trades, taking some of the air out of bitcoin’s recent bounce and knocking the crypto back to retest last week’s levels.

At the same time, the dollar swung around but finished roughly flat, gold chopped its way to a small gain, and silver stole the spotlight yet again, ripping through $58 to log a fresh record and remain one of the few reliable bright spots.

So, as December storms out of the gate with more volatility and metals doing most of the heavy lifting for our diversified portfolios, the big question is whether this mix of strong seasonals, looming rate cuts, and AI crosscurrents will finally settle into a sustained year-end rally—or if choppy, headline-driven swings will keep ruling the tape right into New Year’s Eve.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls who were flexing all last week must’ve taken a long holiday nap – they were nowhere to be found today.

The bears strolled in, took the wheel, and never let go. Equities got slapped around and we kicked off December with a solid red day.

The one bright spot? Metals came to the rescue again. Silver ripped higher like it’s got somewhere to be, gold held tough, and that duo basically kept our portfolios from looking too ugly.

Our TTIs gave back a little of last week’s gains – nothing dramatic, just a modest slip – but they’re still comfortably above their trend lines and in “Buy” mode.

This is how we closed 12/01/2025:

Domestic TTI: +5.69% above its M/A (prior close +6.42%)—Buy signal effective 5/20/25.

International TTI: +9.14% above its M/A (prior close +9.56%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli