- Moving the market

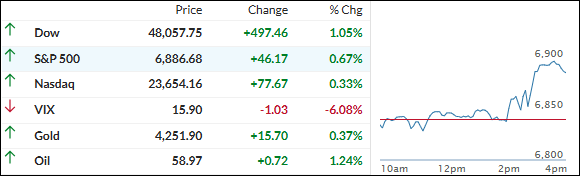

The market spent most of the morning just shuffling around the flat line as everyone waited for the Fed, but things changed quickly once the decision hit.

By the close, stocks were solidly higher, with gains broadening out across almost every corner of the market.

The Fed did exactly what traders were hoping for, cutting rates by another 0.25%—its third straight reduction—and Chair Powell avoided saying anything that might kill the mood.

While there was some pushback inside the committee, his tone stayed comfortably dovish, which was all the market needed to hear.

After treading water early on, the major indexes flipped into rally mode, helped along by a late-day short squeeze that lifted nearly every sector into the green.

Bond yields slipped, and the “risk-on plus hedges” trade showed up in full force: Bitcoin jumped back above $94,000, gold pushed through $4,250, and silver briefly ripped above $62 before easing just under that mark into the close.

As expected, the dollar weakened and ended the day right back where it was at the time of the prior FOMC meeting, underscoring how much the focus has shifted toward easier policy and looser financial conditions.

With the long-anticipated rate cut now delivered and the Fed sounding more helpful than harmful, the big question is whether this sets the stage for the classic Santa Claus rally—or if lingering growth and inflation worries will cap the upside into year-end.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The morning was a total snooze-fest – everything just limped sideways while we waited for Powell to speak.

Then, right on cue, he delivered the 25-bps cut everyone was expecting… and boom, the buy button got absolutely smashed.

What followed was one of those beautiful, broad-based rallies we’ve been craving: pretty much every sector, small caps, cyclicals, tech – you name it – plus gold, silver, miners, and bitcoin all piled in. No narrow Mag-7 nonsense today.

Our TTIs loved every second of it. Both jumped nicely, and the domestic one straight-up stormed ahead like it was on a mission.

This is how we closed 12/10/2025:

Domestic TTI: +7.06% above its M/A (prior close +5.58%)—Buy signal effective 5/20/25.

International TTI: +9.87% above its M/A (prior close +8.95%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli