- Moving the market

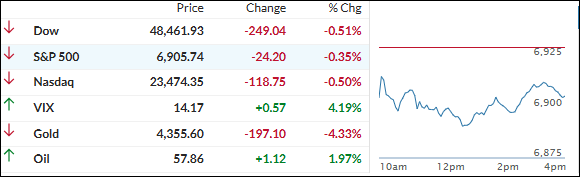

After last week’s record highs and Santa Claus vibes, the market woke up grumpy.

Stocks opened lower and stayed that way, with tech taking the biggest beating. The AI trade cooled off again: Nvidia dropped almost 2% (giving back a chunk of last week’s 5%+ pop), and Palantir, Meta, Oracle, and AMD all bled too.

The real drama was in the shiny stuff. Silver had touched $80/oz overnight for the first time ever but got absolutely smacked today—down about 7% in the SLV ETF, erasing most of Friday’s gains.

Gold fared a little better: hit $4,550 overnight, then fell 4.4% to around $4,350. Both pulled back to levels we saw just 3-4 days ago—not catastrophic given their monster 2025 runs (silver +150%, gold +62%).

Bitcoin did its classic weekend pump-and-dump: spiked to $90K, then plunged below $87K in hours.

The major indexes all closed red, wiping out a good chunk of that late-December “Santa Claus” rally for now. Bond yields eased, and the dollar perked up a touch.

ZeroHedge dropped an interesting stat: every time silver has fallen more than -6% from a 1-year high, it’s been higher a week later—6 out of 6 times.

Hmm…

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The market opened in the red and basically stayed grumpy all session long. No big comeback, just steady selling pressure that carried through to the close.

The precious metals got hit the hardest—gold, silver, and the miners all took a decent step lower. That said, with how insanely strong they’ve been YTD, this pullback feels more like a healthy breather than anything that breaks the bigger uptrend.

Our TTIs felt the drag too and pulled back moderately, but nothing dramatic enough to flip the script. We’re still solidly in positive territory with the overall outlook unchanged.

This is how we closed 12/29/2025:

Domestic TTI: +6.64% above its M/A (prior close +6.82%)—Buy signal effective 5/20/25.

International TTI: +10.00% above its M/A (prior close +10.05%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli