- Moving the market

The major indexes didn’t go far today, drifting around the flat line as Wall Street shifted into full wait-and-see mode ahead of tomorrow’s Fed decision.

With this being the last policy meeting of the year, traders were more interested in what’s coming than in making big moves intraday.

Right now, markets are heavily leaning toward another quarter‑point rate cut, matching what the Fed delivered in September and October, with odds up to roughly the high‑80% range versus the mid‑60s about a month ago.

A cut may feel almost baked in, but the real market driver will be the updated economic projections and what Chair Powell says about growth, inflation, and how much easing is left in the tank.

Given the recent pullback in stocks and crypto, risk‑on traders are clearly hoping the Fed will grease the skids for a year‑end rally instead of cooling the tape with cautious talk.

At the same time, policymakers are juggling sticky inflation, murky macro signals, missing or delayed data from the long government shutdown, and the broader uncertainty around Fed leadership as 2026 approaches.

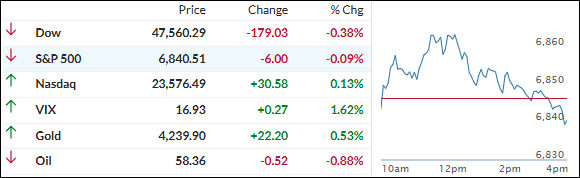

By the close, the major indexes mostly churned sideways, with only the Nasdaq managing a small gain. Economic reports were a mixed bag, even as the Citi Economic Surprise Index ticked higher, hinting that data has lately been coming in a bit better than forecasts.

Under the surface, bond yields pushed higher again, but the real fireworks were in precious metals and Bitcoin.

Bitcoin ripped back toward four‑week highs near 94k, gold added modestly while holding comfortably above 4,200, and silver stole the spotlight with a 4.7% jump to break through the 60 level for the first time ever—a fresh record and another sign of how aggressively money has been rotating into metals.

With so many cross‑currents—from inflation and growth worries to delayed data, leadership questions, and a market still leaning heavily on the promise of easier policy—the big question now is whether the Fed can deliver a dovish-enough message to keep this fragile risk‑on tone alive into 2026, or whether its dual mandate will force a more cautious stance that reins in the doves.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The market basically spent the whole day hugging the flat line, like everyone was holding their breath waiting for tomorrow’s Fed decision.

The Nasdaq managed to sneak out a tiny green close, but the Dow and S&P just yawned and finished dead even.

Pre-Fed nerves were obvious—no one wanted to make big moves, so volume was light and new commitments were basically zero.

The broad market went nowhere fast, and both of our TTIs gave back a little ground—just a modest slip, nothing dramatic.

This is how we closed 12/09/2025:

Domestic TTI: +5.58% above its M/A (prior close +5.78%)—Buy signal effective 5/20/25.

International TTI: +8.95% above its M/A (prior close +9.14%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli