- Moving the market

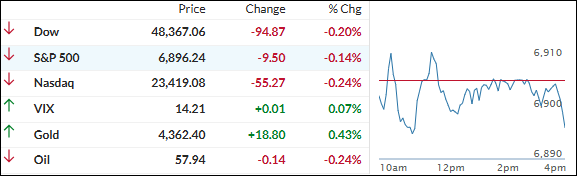

The market was in full “where do we go from here?” mode all morning—wandering aimlessly after the S&P 500 just posted back-to-back losses, mostly thanks to tech getting hammered again.

Investors kept trimming some of this year’s big winners, with Nvidia down over 1% and Palantir sliding 2.4%.

By the close, the major indexes all settled modestly lower, with small caps feeling the most pain.

The bright spot (as usual lately) was the metals sector. They bounced right back into the green: silver led with a strong +4.5% rebound, copper posted a solid +3.2%, and gold edged a little higher.

Bond yields basically yawned and went nowhere—the Fed Minutes dropped without much fanfare, and 2026 rate-cut bets stayed pretty steady.

Bitcoin squeezed out a small gain but couldn’t hold its intraday highs around $89K—faded a bit in the afternoon, classic crypto.

Just one more trading day left in 2025 before we flip the calendar and see what fresh surprises the new year brings.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

“Aimless drifting” pretty much sums it up. The major indexes spent the whole session wandering around the flat line with no real conviction either way.

Bulls were nowhere to be found, so everything quietly slipped into the red by the close—small caps took the biggest hit.

The metals corner had a bit more life, but even there the excitement faded late. Everything pulled back from intraday highs, though silver held up the best, with copper right behind it.

Our TTIs basically mirrored the stocks—just went sideways in a super-tight range, finishing almost exactly where they closed yesterday.

This is how we closed 12/30/2025:

Domestic TTI: +6.47% above its M/A (prior close +6.64%)—Buy signal effective 5/20/25.

International TTI: +10.03% above its M/A (prior close +10.00%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli