- Moving the market

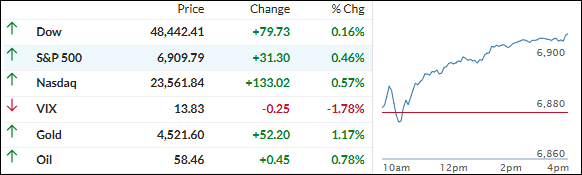

The day started a little wobbly—delayed Q3 GDP data finally dropped and came in hot at 4.3% (way above the 3.2% guess).

That had everyone pausing to wonder if the Fed might slow-walk those early-2026 rate cuts. Futures traders nudged up the odds of steady rates in January and March a touch, but they’re still betting on two cuts by year-end.

Early nerves turned into afternoon buying, though. The indexes shook off the slump, with the Nasdaq leading the charge. The S&P 500 hit a fresh record high, and all the majors locked in their fourth straight green day. Nice way to head into the holidays.

Bond yields crept higher (but backed off the peaks), the dollar sank to October lows, and that was rocket fuel for metals:

Gold got within a whisker of $4,500, silver blasted through $71 (though it stopped shy of $72), and copper punched another record high. Bitcoin lagged a bit and couldn’t crack $88K.

Uncertainty’s still hanging around—it’s just been shoved to the back burner while seasonal tailwinds take the wheel.

We’re enjoying the calm ride for now, but volatility’s always lurking in the shadows.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The session got off to a bit of a shaky start—early hiccup had things looking iffy—but the buyers quickly shook it off, found their groove, and never looked back. By the close, the major indexes were all in the green again for another solid win.

The S&P 500 even punched through to a brand-new record high—pretty cool milestone.

That said, the rally felt pretty narrow (mostly the usual big names doing the heavy lifting), so breadth wasn’t great.

Our domestic TTI actually dipped a touch on the day, while the international TTI managed a modest little gain.

This is how we closed 12/23/2025:

Domestic TTI: +6.34% above its M/A (prior close +6.59%)—Buy signal effective 5/20/25.

International TTI: +10.42% above its M/A (prior close +10.09%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli