- Moving the market

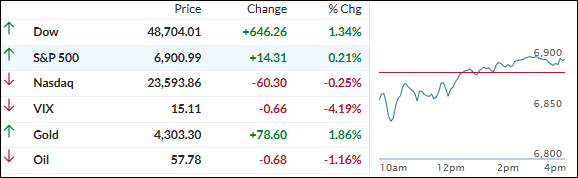

The market was split today: the Dow pushed to fresh highs, while the S&P 500 and Nasdaq slipped early on as renewed worries about pricey tech and AI plays took some air out of yesterday’s Fed-fueled optimism.

The rate cut glow from the prior session was still there, but Oracle’s numbers reminded traders that not every big AI story is translating cleanly into earnings just yet.

Oracle sank about 13% after missing on revenue and flagging higher spending, which also sharpened concerns about its growing debt load.

That disappointment spilled over into the broader AI space, with names like Nvidia, Broadcom, and AMD all trading lower and taking a bite out of the tech complex’s recent momentum.

Those moves hit right as the S&P 500 was flirting with new highs following the Fed’s third rate cut of the year and its decision to effectively take hikes off the table.

Small caps, tracked by the Russell 2000, remained a bright spot, as lower rates tend to benefit smaller, more rate‑sensitive companies, and they even managed a record close yesterday.

By the end of the day, every major sector except tech finished above the flat line, leaving the Mag 7 cohort trailing the other 493 S&P names by a wide margin.

Bond yields were mixed, the dollar extended its slide, and hard assets stole the show: gold pushed above $4,300 and edged closer to record highs, silver punched through $64 intraday to notch yet another record as it continues to run ahead of gold, and copper quietly added about 1.6%.

Bitcoin chopped around with Oracle’s swings but still managed to finish above $91,000, underscoring how jumpy sentiment remains even after the Fed’s attempt to calm things with another cut and dovish messaging.

With tech wobbling, metals ripping, the dollar sliding, and crypto still volatile, the big question now is whether this tug‑of‑war ends in a healthy rotation beneath the surface—or if renewed AI and valuation worries end up derailing the broader rally into year‑end.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Dow was straight-up the star of the show – punched through to a brand-new all-time high and never looked back. Bulls were popping champagne all session long while that blue-chip beast just kept grinding higher.

Tech, on the other hand, was the grumpy and actually finished in the red (shocker in 2025, right?). But the rest of the market didn’t care – cyclicals, financials, small caps, industrials… everything else stepped up big-time.

That beautiful broad participation gave our TTIs a nice juice-up – both popped solidly higher and made our already-positive outlook look even stronger.

This is how we closed 12/11/2025:

Domestic TTI: +7.93% above its M/A (prior close +7.06%)—Buy signal effective 5/20/25.

International TTI: +10.56% above its M/A (prior close +9.87%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli