ETF Tracker StatSheet

You can view the latest version here.

STOCKS TRED WATER; METALS EXPLODE – PORTFOLIO SMILES ANYWAY

- Moving the market

Traders came back from Christmas ready to buy, pushing the S&P 500 to a fresh record high in early trading.

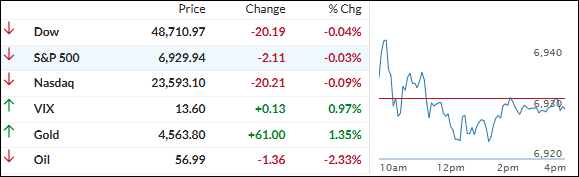

The day itself was pretty sleepy—major indexes basically trod water and closed little changed—but the week told a happier story.

The S&P gained over 1%, the Dow and Nasdaq both up more than 1% too, putting us on track for the fourth weekly win in five. Classic post-Christmas quiet, but still grinding higher.

We’re smack in the middle of that historically sweet seasonal window, so everyone’s keeping an eye out for the famous “Santa Claus rally” (the last five trading days of the year plus the first two of January).

Bond yields finished the week flat, but the dollar had its worst week since June and closed at October lows. Today’s real fireworks? Once again in the metals corner:

– Gold ETF up a “modest” 1.16%

– Copper ripped +4.71% to a new record

– Silver stole the show with a massive +9.05% surge—another all-time high

That combo gave our portfolios a nice lift even while stocks took a nap. Bitcoin did its usual pump-and-dump routine and ended the week around $87K.

Next week we wrap up December and 2025 with another four-day session (New Year’s Day off). Key data on deck: FOMC minutes, a bunch of housing reports, and Chicago PMI.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes got off to a peppy start with a nice early bounce, but then… crickets. The rest of the day turned into a total snooze-fest, and by the close everything was basically flat—barely a ripple.

The real action was in the metals corner. Gold, silver, and the miners reigned supreme, delivering solid gains, and giving our portfolios the firepower they needed to advance.

Our TTIs pretty much mirrored the stock market’s nap—stayed flat on the day—but they still edged a bit higher for the week overall. Small steps forward count.

This is how we closed 12/26/2025:

Domestic TTI: +6.82% above its M/A (prior close +6.73%)—Buy signal effective 5/20/25.

International TTI: +10.05% above its M/A (prior close +10.59%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli