ETF Tracker StatSheet

You can view the latest version here.

METALS HIT RECORDS; MAG 7 OUTPERFORMS – INGREDIENTS FOR UPSIDE ALIGN

- Moving the market

The market kicked off with a serious bang—major indexes rocketed higher early, led by the Nasdaq on a massive 7% pop in Oracle.

That helped breathe new life into the AI trade after a rough patch. Oracle had been in the doghouse this week after losing a key partner on a big data center project (which dragged down Broadcom, AMD, and others), but today’s surge flipped the script.

Nvidia added over 3% on reports the Trump admin is eyeing letting them sell advanced AI chips to China again (H200s to “approved customers”). Still, with valuations sky-high, folks are bracing for more chop into 2026—even if these are some of the strongest credits out there.

This week’s data painted a Goldilocks picture: tame inflation but enough economic softness to keep the Fed in play. Traders are now betting on cuts in March and June 2026, giving stocks more runway.

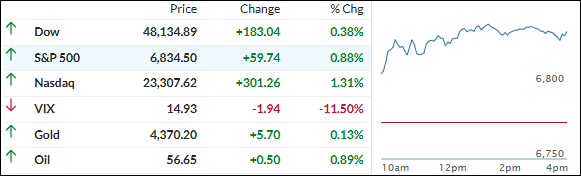

By Friday’s close, the S&P 500 clawed back to flat for the week, the Nasdaq squeezed out a modest gain, and the Mag 7 outperformed the other 493 S&P names—classic AI resurgence.

That monster options expiration passed without a hiccup.

Metals stole the show: gold and silver both hit new record closes (gold over $4,350, silver topping $67), while copper flirted with old highs. Bond yields eased; Bitcoin rode its usual rollercoaster to finish slightly lower.

Big picture: fiscal stimulus is kicking in, money’s getting looser, political noise is fading, and seasonality’s on our side. The road might zig-zag, but the setup for upside into year-end looks solid.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The biggest options expiration in history—$7.1 trillion notional—rolled through like it was no big deal. Zero drama, zero pin-risk chaos.

Bulls stayed fully in control from the opening bell all the way to the close. Smooth sailing.

For once, everything moved together in perfect harmony: equities ripped higher and the metals joined the party—gold, silver, miners all surging in sync. Crypto tagged along too. Just a feel-good, risk-on day across the board.

Our TTIs loved every minute of it. Both maintained their elevated positions above their respective trend lines.

This is how we closed 12/19/2025:

Domestic TTI: +6.23% above its M/A (prior close +6.17%)—Buy signal effective 5/20/25.

International TTI: +9.47% above its M/A (prior close +9.50%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli