ETF Tracker StatSheet

You can view the latest version here.

METALS KEEP SHINING, TECH KEEPS WHINING – WHAT’S NEXT?

- Moving the market

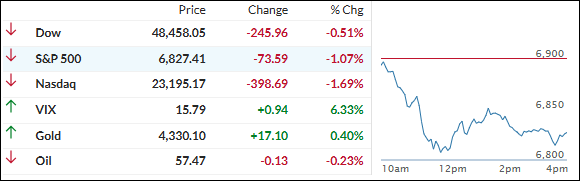

The Dow kicked things off by flashing a fresh record high—value and cyclicals were still getting love while everyone kept dumping tech.

But that early pop ran out of gas fast, and by mid-morning all three major indexes were sliding into the red, with the Nasdaq taking the biggest beating.

The main villain? Broadcom cratered 9% even after beating earnings and guiding AI chip sales to double**. That reignited the whole “when do we actually see ROI on this AI spending?” panic.

Palantir, Micron, and the usual suspects got dragged lower too. Meanwhile, financials, health care, and industrials quietly picked up some gains—classic rotation trade in full swing.

It was a wild, confusing week: dovish Fed + decent macro data on one side, AI profit-taking and valuation jitters on the other. End result? Nasdaq and S&P finished as the week’s big losers, while the Dow and small caps held up way better.

The Mag 7 got absolutely crushed mid-week onward, while the other 493 S&P names actually outperformed.

Bonds were mixed, the dollar hung near 3-month lows, but precious metals kept stealing the show—gold topped $4,300, silver kissed $65 intraday (another new record) before a little profit-taking hit.

Bitcoin? Pure rollercoaster but closed the week basically flat.

Quick question as we’re heading into the weekend: with tech getting punished but the broad market hanging tough and metals still on fire, does this feel like a healthy rotation that sets up a real year-end push… or the first little hairline crack in the 2025 bull story?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Dow was the only one feeling frisky at the open, but that vibe lasted about five minutes.

Sentiment flipped hard, and the major indexes spent the rest of the day sliding into the red—Nasdaq got hit the hardest and never even pretended to come back.

The metals were actually holding up pretty well for most of the session, but silver got taken out back in the afternoon and gave up a chunk of yesterday’s shiny new record high.

Even though the broad market (small caps, cyclicals, financials) clearly outperformed tech today, it still wasn’t enough to save the day.

Our TTIs both took a moderate step lower after running hot lately. The international one hung tougher, while the domestic TTI felt most of the pain.

This is how we closed 12/12/2025:

Domestic TTI: +6.84% above its M/A (prior close +7.93%)—Buy signal effective 5/20/25.

International TTI: +10.05% above its M/A (prior close +10.56%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli