- Moving the market

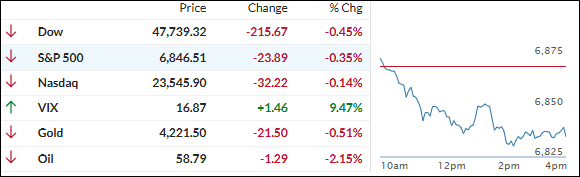

We started with a little sparkle in the Nasdaq, but the Dow and S&P never really got off the ground.

Then the whole mood flipped—tech gave back its early pop, yields in the U.S. and Japan shot higher (10-year hit its highest level since early September), and everything slid into the red by the close.

A couple bright spots: Broadcom jumped 2% to a fresh record after word that Microsoft is talking custom chips with them, and Confluent absolutely rocketed 28% on news IBM is buying it for $11 billion (deal closes mid-2026).

Last week was solid—second green week in a row, S&P and Nasdaq had four-day streaks, Dow positive three of the last four—but Friday’s soft PCE print is looking like old news now.

Crypto got dragged lower with stocks, though Bitcoin squeaked out a tiny green close. Gold gave up some ground but clung to $4,200 like a champ.

Bottom line: the “rate-cut relief rally” we were counting on for Wednesday is starting to feel a little wobbly with yields spiking again.

As yields are suddenly flexing and the easy money trade looking shaky, we’re still riding into the Fed meeting full steam.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

We opened with a little sparkle, but that quickly got stomped out. The bears rolled in, took total control, and shoved everything lower – major indexes, gold, silver…

The main buzzkill? Bond yields climbing all over the world and sucking the air out of risk assets. The one weird outlier? Bitcoin basically shrugged and said “not today” – it hung in there like a winner.

Our TTIs couldn’t dodge the mess either. Both pulled back a modest amount – nothing dramatic, but definitely gave up some ground.

This is how we closed 12/08/2025:

Domestic TTI: +5.78% above its M/A (prior close +6.41%)—Buy signal effective 5/20/25.

International TTI: +9.14% above its M/A (prior close +9.65%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli