- Moving the market

We started the day on a cheerful note, with the major indexes pushing higher right out of the gate—mostly thanks to tech and AI names getting their groove back.

Nvidia climbed over 1% on news they’re eyeing mid-February shipments of H200 chips to China. Micron and Oracle each added about 2%, giving the whole AI crew a nice lift after last week’s solid rebound.

Investors are still rotating into cheaper corners of the market (value, cyclicals) amid all the “are tech valuations too crazy?” chatter, so everyone’s watching to see if AI can hang onto leadership into year-end.

There’s been some doubt about a real Santa Claus rally kicking in—the S&P’s been flirting with a key technical level—but today eased a lot of those worries. Breadth was strong, and pretty much every asset class got in on the fun.

Even rising bond yields couldn’t spoil the mood (though they did knock the dollar lower all session).

That weakness was rocket fuel for precious metals: gold and silver both blasted to new record highs. Bitcoin started strong but gave it all back late and closed flat.

Quick question for you: when stocks grind higher, but metals are the ones smashing all-time highs, does it feel like pure risk-on harmony across the board… or a subtle sign some folks are quietly hedging just in case?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls owned the day from start to finish—no drama, just steady buying.

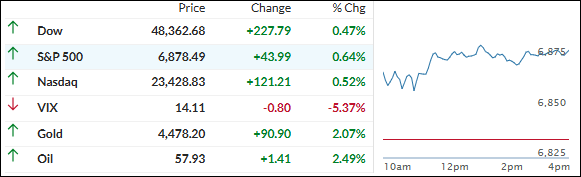

The major indexes all closed higher, with the S&P 500 leading the pack. Nice, solid gains across the board.

The real fireworks, though, were in the precious metals corner. Gold and silver both ripped over 2% and punched through to brand-new record highs. That sector straight-up stole the show.

Our TTIs were right there with the good vibes, posting solid advances and keeping the bullish momentum rolling.

This is how we closed 12/22/2025:

Domestic TTI: +6.59% above its M/A (prior close +6.23%)—Buy signal effective 5/20/25.

International TTI: +10.09% above its M/A (prior close +9.47%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli