- Moving the market

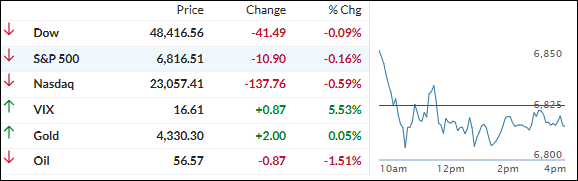

The market tried to get something going early, but the bounce fizzled and the major indexes slipped back into the red as pressure in the AI space kept weighing on sentiment.

Chipmaker Broadcom dropped more than 4%, while Oracle slid over 3%, extending last week’s weakness that already had the S&P 500 and Nasdaq on the back foot.

For now, it’s starting to look like the “Magnificent 7” may be a little less magnificent heading into 2026, as fierce competition in the AI race chips away at the dominance they’ve enjoyed.

That kind of shake-up could be a long-term win for the “other” 493 stocks in the S&P 500, which stand to benefit if leadership broadens out beyond a handful of mega-cap names.

This week’s data could play a big role in whether that rotation sticks. November nonfarm payrolls and October retail sales—both delayed by the fall government shutdown—are due Tuesday, with economists looking for roughly 40,000 new jobs, down sharply from September’s 119,000.

Then on Thursday, the November CPI report lands, giving markets a fresh read on the inflation side of the Fed’s mandate.

Away from equities, bond yields were mixed, Bitcoin slid to a two-week low before finding support around 85,000, and gold briefly tested Friday’s highs before pulling back to finish with a modest gain.

Silver ripped higher again to close above 64, and copper tacked on nearly 1%, underscoring how consistently the metals complex has helped shore up portfolios on days when stocks can’t get out of their own way.

With AI leaders stumbling, economic data back in focus, and metals quietly doing the heavy lifting, the question now is whether this is the early stage of a healthier, more diversified market—or just another pause in an AI-dominated story that comes roaring back once the next batch of headlines hits.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

We started with some real energy—buyers pushed hard early on, and it looked like we might string together another green day. But that optimism faded fast.

The bears snuck in, flipped the script, and by the close the major indexes were all dipping into the red.

Losses were pretty mild overall—no bloodbath—but tech took the hardest hits again.

Meanwhile, our TTIs shrugged off the noise and actually squeezed out a tiny little gain. Small wins count!

This is how we closed 12/15/2025:

Domestic TTI: +6.98% above its M/A (prior close +6.84%)—Buy signal effective 5/20/25.

International TTI: +10.17% above its M/A (prior close +10.05%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli