- Moving the market

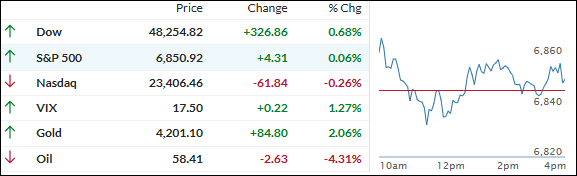

The Dow soared past 48,000 for the first time ever, extending its record-breaking streak and outshining the rest of the market.

Strong rallies in financial heavyweights like Goldman Sachs, JPMorgan, and American Express powered the index higher, alongside fresh highs for UnitedHealth, IBM, and Nike. Bank shares broadly joined in, contributing to the Dow’s milestone run.

In the tech world, Advanced Micro Devices ran up more than 8% after CEO Lisa Su projected the AI data center market could hit $1 trillion by 2030, further fueling investor excitement.

It’s another day of split personality for stocks: blue chips and consumer names continued to prop up the Dow, while the tech-heavy Nasdaq struggled as traders leaned into sectors with lower valuations.

All eyes are now on Washington, as a final vote on the government funding bill could soon put the shutdown behind us.

The Mag 7 basket of high-profile tech and AI stocks lagged again, underperforming the rest of the S&P 500, even as metals and commodities rose sharply.

Gold jumped over 2% to reclaim $4,200, while silver soared past $53, and Bitcoin lagged further behind the shiny stuff.

Is the shift from tech to blue chips here to stay, or will the Nasdaq and growth stocks stage a comeback once the shutdown cloud lifts?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Dow kept its winning streak alive and ramped to another record, while the S&P 500 treaded water and the Nasdaq couldn’t escape the red, dragged down by ongoing tech sector weakness.

Even as the blue chips raced ahead, technology shares struggled, especially those caught up in the recent artificial intelligence trade.

Still, the broad market held up well, which was reflected in our TTIs. Both registered gains for the session, with breadth improving and the broad rally lifting a variety of sectors beyond just the Dow.

This is how we closed 11/12/2025:

Domestic TTI: +6.13% above its M/A (prior close +5.88%)—Buy signal effective 5/20/25.

International TTI: +11.74% above its M/A (prior close +11.17%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli