- Moving the market

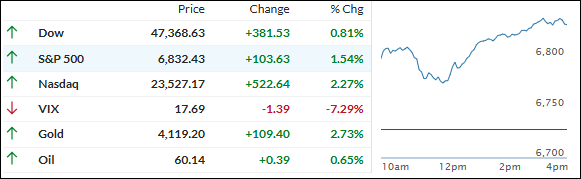

Stocks powered higher right at the open as news of Senate progress on a deal to end the historic U.S. government shutdown fired up traders and renewed risk-taking across the board.

Leaders of the artificial intelligence bull market, including Nvidia, Broadcom, and Microsoft, were quick to catch a bid after being dinged last week by fears about frothy valuations in the AI space.

Microsoft finally broke out of its longest losing streak since 2011, adding to the tech-fueled rebound as optimism mounted that a funding bill could soon reopen the government and reverse some mass federal layoffs.

Senate approval of a critical procedural measure brought a resolution within reach, with more key votes lined up before the deal can become law.

While market breadth still left something to be desired, the Mag 7 basket once again outperformed the rest of the S&P 500 thanks to strength in AI names.

On the macro front, bond yields finished below their early highs as expectations for a December rate cut slipped, and the dollar continued to unwind its recent surge.

Metals markets stole the show, with gold soaring 2.7% to top $4,100, silver rallying 4.3% and breaking through $50, and copper adding over 3%. Bitcoin rebounded to reach $106,000 after some recent volatility.

Could this government shutdown breakthrough be the catalyst for a more lasting market rally, or will some new curveball knock the bulls off balance next?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets sprang to life on news that a deal to end the historic government shutdown was finally within reach, fueling a broad rally that lifted nearly all asset classes.

The metals sector outshined, surging in anticipation of more liquidity hitting the system as federal spending resumes.

Our TTIs joined in on the optimism, snapping out of their recent slump and regaining some ground as risk appetite returned. It was a classic “risk-on” move, reflecting traders’ relief and growing sense that activity will soon get back to normal.

This is how we closed 11/10/2025:

Domestic TTI: +5.27% above its M/A (prior close +4.67%)—Buy signal effective 5/20/25.

International TTI: +10.04% above its M/A (prior close +9.09%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli