- Moving the market

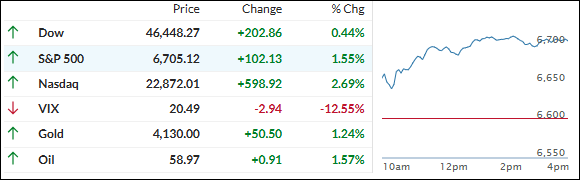

The markets came in determined to bounce into Thanksgiving week, and the bulls actually delivered.

We opened strong and never really looked back—nice, steady grind higher all day. Alphabet was the star of the show, jumping 5% after Google dropped word of “Gemini 3” last week (their latest “we’re still in the AI race” flex).

That lit a fire under the whole mega-cap crew, and they dramatically outran the other 493 names in the S&P 500 by a mile.

The major indexes are trying to claw back some dignity after a rough November—S&P down 2%+ so far this month, Nasdaq off over 4%, Dow also bleeding.

But Friday’s rebound, sharply rising December rate-cut odds and a juicy short squeeze gave us the fuel to stay green today.

Bond yields slipped, the dollar just chilled, and the precious metals went nuts: gold surged 1.5%+ back above $4,100, silver ripped 2.9% past $51. Even bitcoin shook off the morning wobble, climbed over the weekend, and settled around $88K.

Volumes will get thin fast this week with everyone heading into turkey-coma mode, and there’s not much on the calendar until the Fed meeting in December… so expect some random air pockets.

Still, for now the vibe feels a lot better than it did a week ago.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

From the moment the bell rang, the bulls grabbed the wheel and never looked back. No drama, no reversals—just steady, confident buying all day long.

The major indexes closed with nice, solid gains, and the precious metals (gold, silver, miners) tagged along for the ride too.

That combo gave our TTIs a sweet lift—both finished higher and are still comfortably above last Thursday’s low, so the recovery stays on track.

All in all, it was one of those clean, feel-good days we’ve been waiting for.

This is how we closed 11/24/2025:

Domestic TTI: +3.84% above its M/A (prior close +3.41%)—Buy signal effective 5/20/25.

International TTI: +7.61% above its M/A (prior close +7.21%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli