- Moving the market

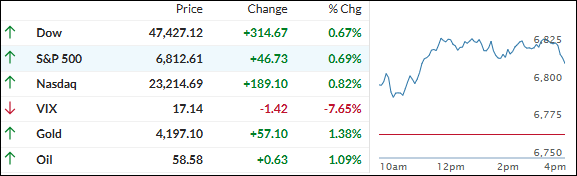

Stocks just refused to take a day off—fourth straight green session locked in, and we’re heading into Thanksgiving with some serious momentum.

The rally stayed nice and broad (not just the usual suspects), with Oracle jumping up 4%, Nvidia and Microsoft both +1%, and small caps plus Nasdaq leading the charge thanks to a juicy short squeeze.

The S&P 500 just posted its best 4-day run since late April—love that.

November’s little 4% dip now feels like ancient history (way shallower than the usual 10% correction), and dip-buyers are clearly still out in force.

Markets are pricing an 82%+ chance of a December rate cut, and Treasury Secretary Bessent just dropped that Trump might name the next Fed chair before Christmas—rumors point to Kevin Hassett, who’s seen as very dovish (aka lower rates, higher inflation… music to stock bulls’ ears).

Bond yields chilled, the dollar slipped, bitcoin blasted back above $90K, gold closed north of $4,150, and silver was the superstar with a nearly 4% pop past $53.

Bottom line: the market is screaming “give us that rate cut” and everything’s lining up for the classic year-end melt-up we’ve all been hoping for.

Wishing you all a fantastic Thanksgiving filled with family, food, and zero market drama! I’ll be back Monday with fresh commentary.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The second that bell rang, it was crystal clear: the bulls showed up, grabbed the wheel, and never let go.

We just wrapped up four straight green days, and this one felt extra good because the rally wasn’t just the usual mega-cap suspects—it was legit broad. Small caps, cyclicals, financials… pretty much everyone got in on the fun.

That wide participation did wonders for our TTIs. Both pushed nicely higher and stretched their cushion above their long-term trend lines even further. Love to see it.

This is how we closed 11/26/2025:

Domestic TTI: +6.05% above its M/A (prior close +5.32%)—Buy signal effective 5/20/25.

International TTI: +9.56% above its M/A (prior close +8.60%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli