- Moving the market

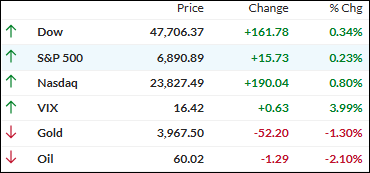

Stocks reached fresh highs Tuesday, but under the surface it was clear this was a tech-powered move—with most of the broad market sitting out the rally.

Strong earnings from big names grabbed attention: United Parcel Service jumped 7% and Wayfair soared 20% on their upbeat third-quarter results, while PayPal rallied 11% after also topping expectations.

Earnings season is proving robust so far; about one-third of S&P 500 companies have reported, and 83% are beating estimates.

The week’s focus is squarely on the “Magnificent Seven,” with Alphabet, Amazon, Apple, Meta Platforms, and Microsoft set to report in coming days—together these giants make up about a quarter of the S&P 500’s value, underscoring their outsized influence on the indexes.

Amazon stole some headlines with news of its largest round of layoffs ever, a move that fits the broader tech-industry trend of cost-cutting in 2025.

The Fed also kicked off its latest meeting, widely expected to deliver a second rate cut this year, with traders hoping Chair Jerome Powell will tee up another cut in December as labor market concerns linger.

Despite the positive action in the major averages, market breadth disappointed—350 S&P 500 stocks closed lower, and gains were concentrated entirely among the big technology names.

Bond yields continued to ease, the dollar fell, gold moderated, while silver found its footing and Bitcoin remained directionless.

If the Fed delivers another rate cut Wednesday, will that finally jolt bitcoin out of its sideways grind—or keep the Mag 7 doing the heavy lifting for the rally?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The tech sector led the charge this morning, powering another green close for the major indexes even as much of the broad market sat on the sidelines.

The standout moves came from familiar names—Nvidia, Microsoft, and Oracle each logged fresh gains on strong demand for AI and cloud computing, while chipmakers and software giants kept the Nasdaq and S&P 500 in positive territory.

Beneath the surface, however, many sectors saw little action—and some even slipped—making today a bit of a one-sided rally.

Our TTIs took the opposite route, reversing some of their recent strength, with the international TTI holding up better than the domestic one.

This is how we closed 10/28/2025:

Domestic TTI: +6.57% above its M/A (prior close +7.50%)—Buy signal effective 5/20/25.

International TTI: +12.29% above its M/A (prior close +12.50%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli