- Moving the market

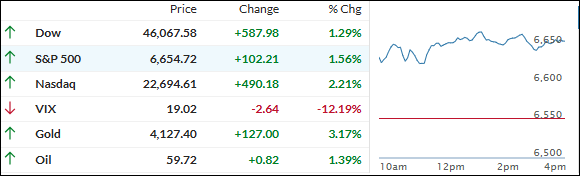

Stocks came roaring back Monday after President Trump toned down his tariff threats and struck a much calmer tone on China, saying trade relations “will all be fine”.

His comments helped reverse much of Friday’s steep selloff when fears of a renewed trade war wiped out roughly $2 trillion in market value.

Tech stocks were the day’s standouts—AMD, Nvidia, and Oracle each gained more than 3%, while Broadcom jumped over 7% after officially announcing a new partnership with OpenAI.

The reassuring tone from Trump’s Sunday post suggested he may not follow through with the 100% tariff threat that had markets rattled, easing investor jitters ahead of his potential meeting with President Xi later this month in South Korea.

Nearly 80% of S&P 500 stocks traded higher, sparking a broad rebound across sectors. Small caps roared back too, with the Russell 2000 surging over 3% after last week’s bruising decline, helped along by what traders called a massive short squeeze.

Precious metals once again stole the show—silver soared more than 4% to break $52, and gold surged past $4,100 for the first time ever.

Bitcoin also bounced, rising back toward $115,000, while the dollar edged up slightly.

With Washington’s tone shifting from confrontation to calm, will this newfound optimism last—or is it just another temporary ceasefire in the trade drama?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets came roaring back to life today, fueled by Trump’s decision to soften Friday’s tough stance on China and hint at a willingness to keep the door open for dialogue.

Stocks surged out of the gate and kept that upward momentum all session long, clawing back much of what was lost during Friday’s tariff-fueled selloff.

Our TTIs had a good day too, bouncing higher and riding the wave of optimism sweeping through Wall Street.

This is how we closed 10/13/2025:

Domestic TTI: +4.92% above its M/A (prior close +3.91%)—Buy signal effective 5/20/25.

International TTI: +9.72% above its M/A (prior close +9.03%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli