- Moving the market

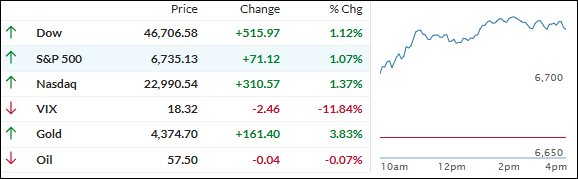

Stocks burst out of the gate this morning, with major indexes surging as traders turned their attention to a heavy week of earnings reports, fresh inflation data, and growing hopes that the prolonged U.S. government shutdown might finally wrap up.

Optimism got an extra boost after National Economic Council Director Kevin Hassett said he expects the shutdown “to end sometime this week,” suggesting moderate Democrats could help strike a deal to reopen the government, now in its 20th day.

The upbeat tone follows a turbulent week marked by trade tensions, regional bank jitters, and weakness in AI stocks. Still, Wall Street is finding its footing again thanks to resilient bank earnings, cooling yields, and improving sentiment.

All eyes now turn to a packed earnings calendar—with Tesla, Netflix, Intel, and Coca-Cola among the big names reporting—as investors look for confirmation that corporate profits remain on solid ground.

By midday, the S&P 500 had jumped over 2% from Thursday’s lows, powered by short squeezing and a rebound in regional financials.

The “Mag 7” stocks outperformed the broader S&P once again, helped by easing yields, with the 10-year Treasury sliding back below 4%.

Gold stole the spotlight, soaring nearly 4%, while silver climbed modestly. Even bitcoin got in on the action, bouncing roughly 4% to approach $111,000 despite a stronger dollar.

With earnings season heating up and talk of a shutdown resolution lifting spirits, can the market keep this momentum going through the end of October—or will volatility make an untimely return?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets kicked off the week with a bang, carrying strong bullish momentum from the open straight through the close.

A few brief pullbacks popped up along the way, but buyers quickly stepped in every time, helping stocks notch a solid start to the week.

Our TTIs mirrored the market’s strong tone, climbing sharply to start the week on a high note.

This is how we closed 10/20/2025:

Domestic TTI: +6.43% above its M/A (prior close +5.37%)—Buy signal effective 5/20/25.

International TTI: +11.52% above its M/A (prior close +10.26%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli