ETF Tracker StatSheet

You can view the latest version here.

BULLS RETURN AS BANKING WORRIES TAKE A BREATHER

- Moving the market

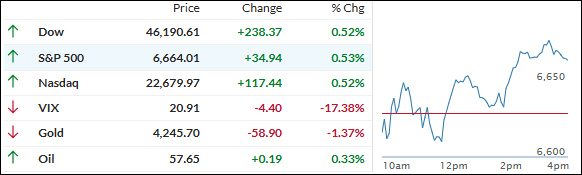

Stocks started the day mixed as traders tried to shake off lingering worries from Thursday’s steep selloff in regional banks. By the afternoon, confidence began to return, and the major indexes firmed up, eventually closing higher to cap off the week on a stronger note.

Regional bank names that led Thursday’s rout bounced back as Wall Street analysts defended the stocks and bet the bad-credit headlines were isolated.

Zions Bancorp, which plunged 13% yesterday after disclosing a $50 million loan charge-off tied to alleged fraud, gained about 2% today after receiving an upgrade. Western Alliance, down 11% on Thursday after revealing similar loan issues, also clawed back some early losses.

Investment bank Jefferies joined the rebound, rising roughly 3% after Oppenheimer raised its rating to outperform, just a day after the stock sank on concerns about exposure to bankrupt retailer First Brands.

For now, most in the market believe recent loan problems at banks like Zions and Western Alliance are one-off situations rather than evidence of a wider credit problem.

By the close, major indexes had stabilized, helped by a relatively quiet tape from the banking and private credit side.

The Mag 7 stocks slightly outperformed the rest of the S&P 500, bond yields finished the week lower, and the 10-year Treasury yield bounced back to 4%.

The dollar just notched its worst week in two months, while gold and silver finally cooled after a relentless run higher. Bitcoin slipped to around $107,000 after briefly hitting $104,000 earlier in the session.

With markets showing signs of steadiness heading into next week, will fresh earnings and inflation data help solidify this rebound, or will lingering credit worries creep back into focus?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks started the day on uneven footing but quickly found their stride, climbing steadily through the session and ending both the day and the week with solid gains.

The rally was helped by a lack of fresh bad news from the regional banking sector, where lingering worries have recently kept markets on edge. Instead, relief over calming credit concerns and easing trade tensions gave investors reason to push back into risk assets.

Our TTIs finished the week with a split outcome—the domestic reading continued to strengthen, reflecting renewed confidence in U.S. markets, while the international indicator slipped, suggesting global investors remain a bit more cautious.

This is how we closed 10/17/2025:

Domestic TTI: +5.37% above its M/A (prior close +5.00%)—Buy signal effective 5/20/25.

International TTI: +10.26% above its M/A (prior close +10.87%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli