ETF Tracker StatSheet

You can view the latest version here.

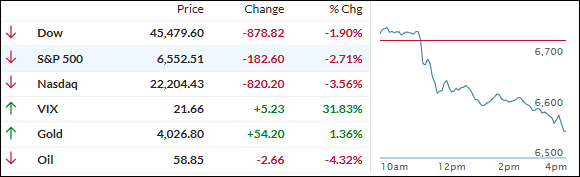

RARE EARTH FIGHT SENDS MARKETS TUMBLING, GOLD AND SILVER RALLY

- Moving the market

Stocks started off on the right foot today, with the S&P 500 and Nasdaq building on the week’s gains—the Nasdaq even notched a new all-time intraday high.

But the mood changed in a hurry after President Trump threatened hefty new tariffs on China, accusing them of being “very hostile” with their rare earth metals restrictions—a major shot across the bow for tech and defense companies.

The drop picked up steam all the way into the close, especially after Trump announced he was scrapping a planned meeting with President Xi and floated a “massive” tariff bump as payback for what he described as China holding the globe “captive” with rare earth controls.

China had already tightened those controls this week, requiring foreign buyers to get a special license from Beijing for products containing as little as 0.1% rare earths. Suddenly, any hope for a near-term China trade deal vanished in record time.

Almost lost in the shuffle, the government shutdown dragged on for a tenth day after the Senate failed—again—to break its deadlock. No real progress on talks, and the lack of fresh economic data isn’t helping traders find direction. At least the University of Michigan’s latest read on the economy and consumer was upbeat.

Today, the “Mag 7” and the rest of the S&P 500 dropped in sync, all ending the week with sharp losses and posting the first 1%+ drop in 48 trading days.

Bond yields softened, with the 30-year Treasury at a three-week low, but there was a silver lining: gold rallied for an eighth straight week, closing above $4,000, and silver followed with its own winning streak thanks to tight European physical markets.

Bitcoin, meanwhile, didn’t act as a haven and slipped for the week.

With global trade nerves this raw, is this just the start of more volatility, or will the market find its footing soon?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets rallied early on but hopes faded quickly as China’s new restrictions on rare earth metals hit an “unacceptable” level—cutting off key materials for tech and defense and sending shockwaves through Wall Street.

President Trump fired back with higher tariff threats and abruptly canceled his scheduled meeting with Premier Xi, pushing the standoff to new heights.

The fallout was instant: major indexes were slammed, finishing deep in the red and led by the Nasdaq’s steep 3.6% drop.

Even our TTIs gave up ground, although they’re still hanging out on the bullish side of their respective trend lines.

This is how we closed 10/10/2025:

Domestic TTI: +3.91% above its M/A (prior close +6.52%)—Buy signal effective 5/20/25.

International TTI: +9.03% above its M/A (prior close +11.52%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli