- Moving the market

Stocks got off to a shaky start as the latest U.S. government shutdown brought uncertainty to Wall Street, with traders focused on how long the funding gap might last—and what it could mean for the economy.

The shutdown, triggered by a breakdown in Senate talks over a temporary spending bill, spotlights key issues like healthcare tax credits and sets the stage for delays in crucial economic data releases.

Historically, the market tends to shrug off shutdowns, but with worries swirling about a softening job market, inflation risk, and frothy stock valuations, investors are paying closer attention this time.

A longer shutdown could keep the Fed guessing on rates, especially since key reports like nonfarm payrolls won’t hit this week.

Today’s private payrolls report showed a surprise loss of jobs—the worst since early 2023—making it even trickier for the Fed, which is widely expected to cut rates again soon.

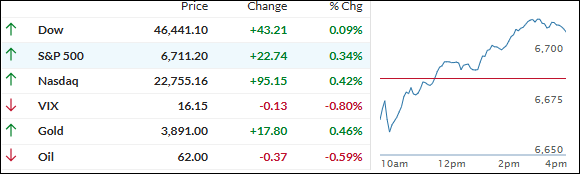

But for now, stocks finished in the green, even as the dollar slid and yields dipped.

Gold and silver flexed their safe-haven muscles by closing in on record highs, while bitcoin jumped above $118k.

With more than 40% of traders expecting this shutdown to stretch past mid-October, the big question is:

Will missing data and new earnings do enough to lift the mood, or will the market’s nerves get the best of it?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

October kicked off on a sluggish note as Wall Street wrestled with the government shutdown, but the major indexes found their stride late in the day, managing a respectable green close.

Our TTIs also spent most of the session playing catch-up before joining the late rally and finishing higher as well.

This is how we closed 10/01/2025:

Domestic TTI: +7.21% above its M/A (prior close +6.96%)—Buy signal effective 5/20/25.

International TTI: +11.71% above its M/A (prior close +11.20%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli