- Moving the market

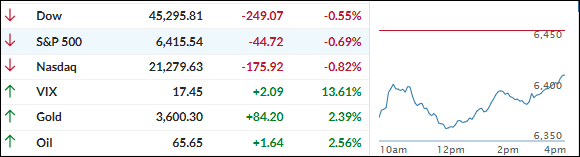

Stocks got off to a rough start this morning and just never caught a break, kicking off what’s usually a tricky month for the market.

The major indexes finished solidly in the red, as traders grappled with fresh tariff drama and rising bond yields that sent Wall Street on edge—the 10-year pushed up to 4.27%, making everyone a bit jumpy.

Pressure ramped up after a federal appeals court ruled most of Trump’s global tariffs illegal, shifting focus to Congress—and prompting talk that the US might have to refund a big chunk of tariff revenue, which isn’t great news for government finances or market sentiment.

Trump wasn’t happy, calling the decision “Highly Partisan,” and said he’ll take it up with the Supreme Court. The combo of legal uncertainty and fiscal worries made it even tougher for stocks to gain traction today.

On a brighter note, the way I see it, things looked much better if you were invested in gold, silver, copper, or bitcoin—all of which rallied hard, as some of us were fortunate enough to have taken shelter outside of equities.

Gold hit a new all-time high, silver jumped 2.7%, copper rallied 1.2%, and bitcoin kept its uptrend alive. Even the dollar got a little bounce, defying recent weakness and hinting that traders were hunting for safer ground.

I believe the next big focus—for both traders and the Fed—is Friday’s jobs report, since it could tip the scales for the mid-month interest rate decision.

Will this bout of market turbulence turn out to be just another brief scare, or is September shaping up to be as tough as history suggests?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The way I see it, September lived up to its reputation for volatility as the major indexes tumbled right out of the gate and never looked back.

Even with all that red in equities, our commitment to holding precious metals and bitcoin paid off—those exposures kept our portfolios afloat and even delivered some gains while the broader market struggled.

Our TTIs slipped alongside stocks but, interestingly, they’re still staying above their key trend lines, so the bigger bullish picture isn’t broken yet.

This is how we closed 09/02/2025:

Domestic TTI: +5.72% above its M/A (prior close +6.56%)—Buy signal effective 5/20/25.

International TTI: +8.95% above its M/A (prior close +9.70%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli