- Moving the market

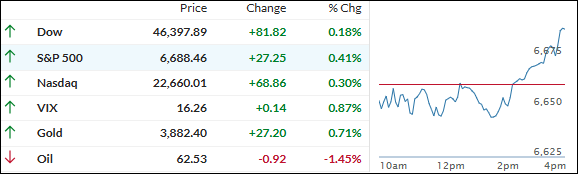

Equites spent most of the day underwater as Wall Street braced for a possible government shutdown, but late-day buying helped the major indexes squeeze out a green close and cap off a better-than-usual September.

Unlike most years, the market sidestepped the usual seasonal weakness—even as headlines warned that this time a shutdown might trigger more volatility, given rising fears about the labor market, stubborn inflation, and high valuations.

While shutdowns rarely move markets for long, traders worry this one could be different—especially since it could delay crucial economic data, like Friday’s jobs report.

The threat of a credit downgrade and talk of mass federal layoffs didn’t help the mood, but Big Tech still powered ahead: the Mag 7 group outperformed, and tech finished far ahead of the rest of the S&P sectors this month.

Bond yields were mixed, but precious metals stole the show. Gold notched its best month since 2011, leaping nearly 12% to a new record, and silver rallied 17%.

Bitcoin had a bumpy ride but clawed back end-of-month gains, while its ETF trailed the big gains in metals.

Now that September’s chill is behind us, October could bring its own tricks. Can the market keep surprising the skeptics—and what happens if the shutdown drags on?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes struggled to make progress for most of the day, stuck below the flatline until a late burst of buying pushed them all into the green.

That last-minute momentum helped stocks end the month on a high note, leaving the outlook looking brighter as we head into October.

Our TTIs followed a similar pattern—starting out slow but picking up steam as the day wore on, both finishing higher.

This is how we closed 09/30/2025:

Domestic TTI: +6.96% above its M/A (prior close +6.68%)—Buy signal effective 5/20/25.

International TTI: +11.20% above its M/A (prior close +10.86%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli