- Moving the market

The S&P 500 and Nasdaq kicked off the day on a high note, thanks to a big legal win for Alphabet.

A federal judge ruled that Google can keep its Chrome browser and isn’t forced to sell off major assets, which had investors breathing a sigh of relief.

Shares of Alphabet soared nearly 7%, while Apple jumped about 3%—the decision lets Google keep paying Apple to make its search engine the default on iPhones, and both tech giants loved that.

This ruling avoided the “worst-case scenario” for big tech and even acknowledged that new advances in AI may be shaking up the search market, which helps explain why the court wasn’t up for breaking up Google right now.

That burst of optimism powered the Mag 7 stocks ahead by 1.6%, even as the rest of the S&P 500 slipped about 0.5%. Basically, tech did all the heavy lifting while most other sectors struggled for traction.

Away from Silicon Valley, signs of a cooling labor market showed up: For the first time since 2021, there are now more unemployed folks than job openings. That’s not a great look for the economy, and it’s something the Fed—and traders—are watching closely.

With all eyes on tech, bond yields took a breather and drifted down, boosting the odds of a Fed rate cut this month to 95%.

The softer dollar gave another shot in the arm to gold and silver—gold jumped to a record high above $3,575 and silver topped $41 for the first time since 2011. Even bitcoin edged higher, holding steady around $112k.

So, after today’s fireworks in tech and a growing sense that the Fed might act soon, the big question is: Can the Mag 7 keep carrying the market higher, or will those cracks in the labor market start to take center stage?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

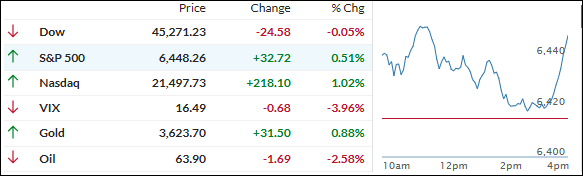

Today, only the S&P 500 and Nasdaq managed to claw back some ground after yesterday’s selloff, while the Dow continued to lag. The way I see it, tech stocks really carried the day, but most other sectors struggled to get any traction, so it wasn’t exactly a broad-based recovery.

That pretty much sums up our TTIs too—they bounced off their worst levels but still ended the session in the red, though losses were pretty mild.

I think it shows we’re still in cautious territory, with traders waiting to see if tech can keep leading the charge or if the rest of the market will catch up.

This is how we closed 09/03/2025:

Domestic TTI: +5.56% above its M/A (prior close +5.72%)—Buy signal effective 5/20/25.

International TTI: +8.91% above its M/A (prior close +8.95%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli