ETF Tracker StatSheet

You can view the latest version here.

GOLD, SILVER RIP HIGHER WHILE SHORT SQUEEZE RALLY ROLLS ON

- Moving the market

Stocks kept climbing, building on a record-setting week after the Fed finally delivered its much-anticipated rate cut.

As expected, the decision to lower the benchmark rate by a quarter point gave equities another leg up—even if Fed Chair Jerome Powell called the move a “risk management cut” and made it clear this isn’t the start of a freewheeling cutting cycle.

Apple led today’s winner list with a 1.4% gain as the new iPhone hit stores, and Tesla climbed 2%.

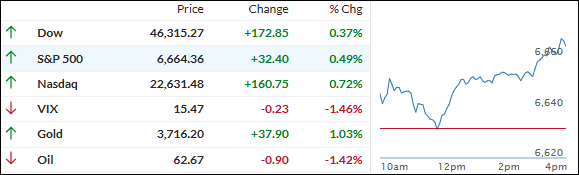

All the major indexes ended the week on a strong note: the S&P 500 and Dow added around 1%, the Nasdaq surged nearly 2%, and the Russell 2000 outperformed, notching its seventh weekly win in a row.

Stubborn inflation and a solid but slightly slowing labor market helped push the Fed to act, but bond yields actually rose for the week—supporting a relentless rally in the most shorted stocks and the Mag 7 basket.

The dollar advanced for a third day, gold capped a fifth straight weekly gain at a new high, and even silver broke out with a 2.7% jump. Bitcoin, meanwhile, cooled off and drifted down to $115k after hitting $118k Thursday.

So far, September has defied its reputation for market whiplash, but with another week and a half to go, will this steady run hold up—or is another bout of volatility right around the corner?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes kept up their winning streak, opening strong and holding onto gains all the way into the close.

It was the Nasdaq and Small Caps leading the charge this week, with the Dow and S&P 500 lagging a bit but still racking up solid advances.

Our TTIs were down today, not changing much from last week—which basically confirms our current outlook: the positive momentum is holding up, just not in a perfectly straight line.

This is how we closed 09/19/2025:

Domestic TTI: +6.41% above its M/A (prior close +6.86%)—Buy signal effective 5/20/25.

International TTI: +11.14% above its M/A (prior close +11.63%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli