- Moving the market

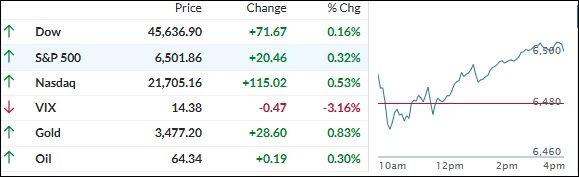

Today’s session reflected a blend of cautious optimism and earnings digestion. The Dow, S&P 500, and Nasdaq all closed at new record highs for the first time in 2025.

I believe traders spent the day weighing Nvidia’s latest “good but not mind-blowing” earnings and a surprise upward revision to US GDP. Surprisingly, the Russell 2000 outpaced the big indexes, notching a solid gain on renewed interest in small caps.

As for the Fed, odds of a September rate cut remain high—around 88%—and the market seems comfortable with the central bank’s slower, steadier approach. The way I see it, uncertainty about Fed independence is lingering thanks to recent headlines, but it hasn’t provoked much anxiety among stock investors.

Bond yields barely moved, signaling no major change in rate expectations. The dollar fell, reflecting mild risk-on sentiment. Gold pushed towards its record highs, as some investors grabbed a bit more safety, given the recent political drama and steady Fed outlook.

Mag 7 stocks were mixed: Nvidia slid just a bit after earnings, while Broadcom popped over 1% and others like Microsoft, Apple, Alphabet, Amazon, and Tesla showed slight increases, with Meta bucking the trend and dropping. I think this split shows traders are still sorting winners and losers in the AI and tech trade—no clear leadership, but plenty of action.

On the digital side, bitcoin managed to snap back about 1% after recent weakness, suggesting traders are getting more comfortable with risk again.

With August winding down, I believe the market’s resilience is impressive—but with rates, tech, and politics all swirling, my question is: will this bullish streak hold up as we head into September, or is it just a summer fling?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

After a messy start, the major indexes managed to regain their composure and put together another winning day.

Momentum picked up as the session wore on, leaving the S&P 500 at another record high and both the Dow and Nasdaq in the green.

Our TTIs had a split day—while the international one sprinted ahead thanks to strength in AI and tech stocks abroad, the domestic TTI mostly held steady and didn’t really push higher.

This is how we closed 08/28/2025:

Domestic TTI: +6.69% above its M/A (prior close +6.74%)—Buy signal effective 5/20/25.

International TTI: +10.53% above its M/A (prior close +10.19%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli