- Moving the market

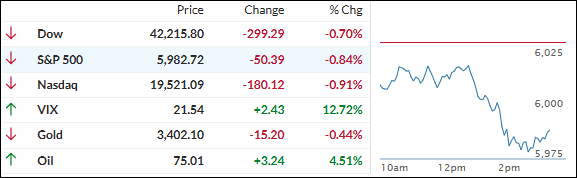

The markets opened in the red today, weighed down by fresh tensions in the Middle East.

Hopes for a ceasefire between Israel and Iran were dashed, as the conflict showed no signs of cooling off—despite earlier reports suggesting otherwise.

Oil prices surged nearly 5%, reversing Monday’s dip that had been sparked by a Wall Street Journal report hinting at Iran’s willingness to negotiate. With the saber-rattling back in full swing, energy markets are on edge again.

Adding to the pressure, retail sales came in weaker than expected. Consumer spending dropped 0.9% in May, missing forecasts of a 0.6% decline.

That’s not a great sign for the economy, especially when paired with other downbeat data: industrial production slipped, and homebuilder confidence hit a 13-year low.

The gap between “hard” and “soft” data is narrowing, and traders took notice—especially in retail, where some of the market’s favorite names took a hit. Meanwhile, the most shorted stocks gave back yesterday’s gains in a hurry.

In other markets, bond yields fell across the board, the dollar had its biggest jump in six weeks, gold stayed flat, and silver popped over 2%. Bitcoin spiked at the open but pulled back, finding support around the $104K mark.

Now, all eyes are on the Fed. Will they surprise Wall Street with a rate cut tomorrow?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes kicked off the day in the red and pretty much stayed there, drifting below the flatline all session long and wrapping things up with a loss.

Our TTIs weren’t immune either—they pulled back a bit from their recent highs. That said, they’re remaining in bullish territory, so our overall positive outlook remains unchanged.

This is how we closed 06/17/2025:

Domestic TTI: +0.72% above its M/A (prior close +1.69%)—Buy signal effective 5/20/25.

International TTI: +5.98% above its M/A (prior close +7.12%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli