- Moving the market

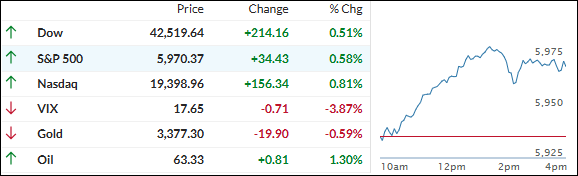

Markets picked up where they left off yesterday, building on modest gains despite a flat start as traders kept a close eye on potential developments in U.S.-China trade talks.**

However, not everything was working in the bulls’ favor. The OECD trimmed its U.S. growth forecast to 1.6% from 2.2%, casting a bit of a shadow over the day’s optimism. That news initially pushed bond yields lower, but they later reversed sharply as hopes for rate cuts began to fade.

Trade tensions remained a key theme, with negotiations between the U.S. and China reportedly hitting more turbulence. Still, some analysts remain upbeat about the market’s short-term outlook, pointing to seasonal trends—historically, the next six weeks tend to be among the strongest stretches of the year, rivaling even the fourth quarter.

On the data front, the JOLTS report surprised to the upside, showing more job openings than expected. That, along with a boost in retail sentiment, helped fuel a midday rally and triggered a short squeeze that pushed markets even higher.

Elsewhere, the dollar rebounded from last week’s lows, putting pressure on gold, which gave back some recent gains. Bitcoin, true to form, continued its rollercoaster ride—up, down, and back up again.

All eyes are now on Friday’s jobs report. With job openings on the rise, the big question is: Will a strong payroll number be good news for stocks—or will it spook investors worried about fewer rate cuts?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes shook off a sluggish start and ended the day solidly in the green, thanks to some encouraging economic data that gave investors a boost of confidence.

Our TTIs moved right in step with the market’s upward momentum.

They not only followed the positive direction but also improved their positions relative to their respective trend lines—a good sign that the broader trend remains intact and supportive of further upside.

This is how we closed 06/03/2025:

Domestic TTI: +1.33% above its M/A (prior close +0.49%)—Buy signal effective 5/20/25.

International TTI: +6.34% above its M/A (prior close +6.23%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli