- Moving the market

The tech sector led this morning’s positive opening, driven by strong quarterly results from Microsoft and Meta.

Both companies exceeded expectations, easing fears that the tariff war and a downturn in the U.S. economy might threaten the AI trade. It appears AI is less impacted than traders initially believed.

Adding to the bullish sentiment was Microsoft’s optimistic guidance, which further alleviated concerns about tech companies’ performance in the coming months. Microsoft’s shares rose by 7.6%, Meta’s by 4.2%, and Nvidia’s by 2.5% in sympathy.

Despite a negative reading of weekly jobless claims jumping to 241,000 versus an estimated 225,000, bullish sentiment remained strong. This is despite increased concerns about the economy following the recent negative first-quarter GDP report.

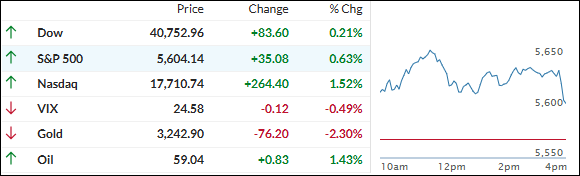

The major indexes started May with moderate gains, even though macro data declined. Bond yields surged, pushing the dollar higher and gold lower, while rate-cut expectations decreased. Bitcoin continued its ascent, reaching $97k today, its highest level since February.

Interestingly, equities have rebounded despite a weakening global economy, a negative GDP reading, and falling oil prices, which put the U.S. at risk of sliding into a recession. This points to shrinking earnings in corporate America.

As ZH noted, even a mild 5% contraction in earnings from 2024 would leave the aggregate earnings per share of the S&P 500 basket at $225, roughly corresponding to a value of $3,874 on the index. The S&P 500 is almost 2,000 points higher than that level.

Will the markets continue to live in denial a little while longer?

On a personal note, I will be out tomorrow, so there will be no Friday post or Saturday Cutline report.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The tech sector dominated and drove major indexes to a positive close, although the broader market did not follow suit.

Consequently, our TTIs diverged from this trend and pulled back.

This is how we closed 05/01/2025:

Domestic TTI: -3.42% below its M/A (prior close -3.29%)—Sell signal effective 4/4/25.

International TTI: +2.12% above its M/A (prior close +2.38%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli