- Moving the market

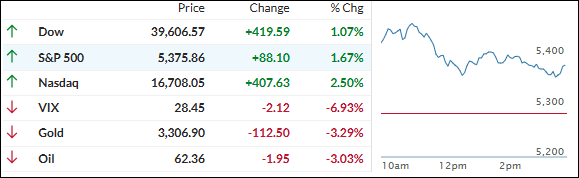

The markets received a significant boost this morning from Trump, who softened his stance on Fed Chair Powell and China tariffs—two topics that had recently caused market turmoil.

First, he indicated that he does not plan to remove Powell from his position as Central Bank leader. Second, he expressed a willingness to adopt a less confrontational approach to negotiations with China, noting that the current 145% tariff on Chinese imports is “very high” and will be significantly reduced.

This was the signal the markets had been waiting for. Even a hint of easing tensions between the two countries brought relief to Wall Street, as traders and algorithms pushed the “buy” buttons, driving the markets sharply higher.

While this is a positive start, it remains to be seen whether this rebound has enough momentum to pull us out of the current bear market. Right now, it’s simply a relief rally, but is it based on false hope?

The markets ended the session off their highs as the headline ping pong continued, dampening the early euphoric reaction. None of today’s events were “new” news; it was merely a reiteration.

Bitcoin ETFs saw a massive inflow yesterday, propelling the cryptocurrency over $94k, its highest level since March.

Bond yields fluctuated wildly, first dropping, and then rising, yet rate-cut expectations fell. The dollar swung dramatically, while gold continued to slip but found support around the $3,300 level.

Uncertainty reigns supreme as the markets remain volatile, with no clear long-term trend direction in sight.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

Early market enthusiasm diminished as the trading session progressed, but the major indexes still achieved notable gains for the second consecutive day.

Our TTIs mirrored this trend, decreasing their distance from their respective trend lines.

This is how we closed 04/23/2025:

Domestic TTI: -5.72% below its M/A (prior close -6.63%)—Sell signal effective 4/4/25.

International TTI: +0.02% above its M/A (prior close -1.25%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli