- Moving the market

Nvidia impacted the global tech market this morning by announcing a $5.5 billion quarterly charge related to its graphics processing units sold to China and other nations. The stock dropped approximately 7% on the news, losing $270 billion in market cap.

Other chipmakers followed suit, moving lower. Big tech also felt the pressure, with the Mag7 index dropping around 2%, and stocks of Meta, Alphabet, and Tesla pulling back as well.

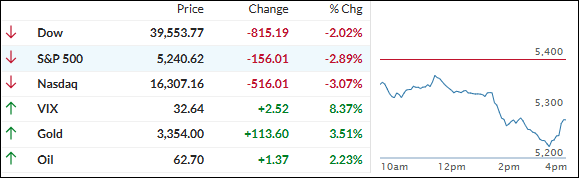

The major indexes were in retreat mode as traders continued to navigate rising global tensions, despite some levies being put on hold for 90 days. However, Chinese goods were not included in this pause, leading to increased market volatility.

Midday, it wasn’t tariff uncertainty but Fed Chair Powell who unsettled the markets with his responses to questions about intervention if the stock market plummets.

Powell stated, “No, markets are doing what they’re supposed to do, orderly…” and “Clearly there is some deleveraging by hedge funds going on; you will see continued volatility.” He also mentioned, “The economy will likely be ‘moving away’ from both of its goals probably for the balance of this year.”

These comments dampened any potential bullish sentiment and discouraged dip buyers. Even a last 30-minute buying spree did not change the outcome.

Bond yields dipped, and the dollar slipped to its lowest level since early October. Bitcoin suffered volatility, racing first to $85.5k and then back down to $83.5k, eking out a small gain.

Gold ended up being the star of the show, with the precious metal adding almost 3.5% for the session, its best day since October 2023, while setting a record.

In my advisor practice, gold has been a core holding since February 2022, allowing us to build a solid foundation to protect against uncertainty and inflation with a fairly high allocation percentage.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The S&P 500 and Nasdaq fluctuated below their respective unchanged lines throughout the session, plunging sharply at midday.

Our TTIs also drifted lower, reinforcing our bearish market stance.

This is how we closed 04/16/2025:

Domestic TTI: -7.74% below its M/A (prior close -6.54%)—Sell signal effective 4/4/25.

International TTI: -2.19% below its M/A (prior close -1.66%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli