- Moving the market

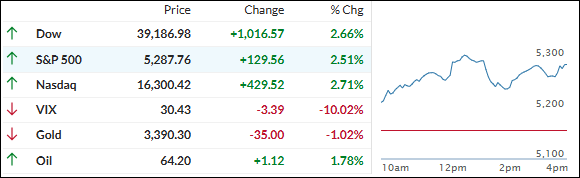

Equities rebounded from yesterday’s selling spree, marking the fourth consecutive losing session, driven in part by global tensions and Trump’s recent criticism of the Federal Reserve.

Major tech players like Tesla, Nvidia, Meta, and Amazon all advanced, while manufacturing giant 3M reported better-than-expected earnings, boosting its stock by approximately 6%.

This earnings season has been frustrating, as the past six weeks have seen significant changes due to tariff policies, heavily impacting companies’ outlooks for the next year and bringing uncertainty to the forefront.

However, yesterday’s sell-off turned into a massive short-squeeze, erasing all losses after Treasury Secretary Bessent calmed nerves by indicating a potential “de-escalation with China,” calling the current situation “unsustainable.”

Bessent later acknowledged that this process might take months, which temporarily dampened upward momentum, but the indexes still managed to close near their midday highs.

The mega-cap sector rebounded strongly but couldn’t maintain its weekly gains. Bond yields ended mixed, while the dollar showed signs of recovery by erasing some of yesterday’s losses.

Gold surpassed the $3,500 level overnight but slipped during the regular session, whereas Bitcoin outperformed, reclaiming its $92k level and aligning with the direction of global liquidity.

Are new highs on the horizon?

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

Despite experiencing an intraday pullback, the major indexes managed to recover and nearly erase the losses from yesterday.

This sudden bullish sentiment can be attributed to Treasury Secretary Bessent’s comments, indicating a potential de-escalation in tensions with China.

While our TTIs also showed some recovery, they remain entrenched in bearish territory.

This is how we closed 04/22/2025:

Domestic TTI: -6.63% below its M/A (prior close -8.87%)—Sell signal effective 4/4/25.

International TTI: -1.25% below its M/A (prior close -2.37%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli